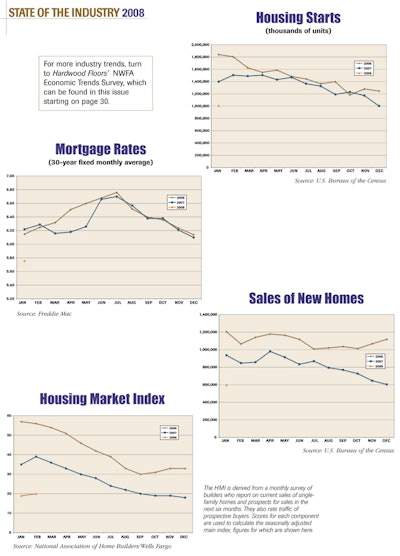

The lowest level of housing starts in 27 years. Foreclosures on the rise. The largest drop in sales of single-family homes in 25 years. Median home prices declining for the first time in at least four decades, perhaps since the Great Depression. The onslaught of bad news about housing in recent months has been relentless; it could almost become background noise if it didn't hit so close to home in the wood flooring industry.

In the midst of these rocky times, the industry has experienced significant changes. Hoboken Wood Flooring LLC, the largest wood flooring distributor in the country, with locations from Maine to Florida, abruptly closed its doors last November, taking its sister company Superior Products Inc. down with it. In one of Hoboken's markets, manufacturers stepped in and opened their own distribution to help fill the void. Longtime wood flooring distributor The Roane Company, which had been in business based in Southern California since 1947, closed in January, and smaller distributors in various markets throughout the country have followed suit. Other distributors have continued to consolidate. At the manufacturing level, floor covering giants Shaw and Mohawk bought Anderson and Columbia, respectively, even more firmly entrenching themselves as leaders in the wood flooring industry.

For the industry, the good news during this challenging time is that wood flooring is still an extraordinarily sought-after floor covering. Additionally, with a market inundated with products, there is a wood floor to suit any taste. The bad news is that although desire for wood flooring is at an all-time high, the current state of the housing industry in North America has negatively impacted all levels of the wood flooring industry. Distributors are examining their businesses and trying to shelter themselves during these stormy times.

Housing Market Landslide

Wood flooring professionals from coast to coast are feeling varying degrees of pain related to the housing market's decline and the overall economy. Distributors interviewed for this story characterized business right now as "at best flat," "mixed," "very, very slow," "difficult," and even "a train wreck," among other more colorful language.

Leading the way in bad housing news is new construction. The pain is more acute in some areas than others, but the slowdown seems to have hit every market. The continual onslaught of bad economic news in the media is only serving to make things worse, they say.

In the Pacific Northwest, which doesn't have the boom or bust swings of other regions, the new housing decline didn't hit until the fourth quarter of last year, says John Peterson, vice president/division general manager at Portland, Ore.-based Emerson Hardwood Floors. "I think there's a lot of people with money on their hands, but on the new construction side, they've been told if they wait 12 months they're going to pay a lot less," he explains, adding that people also seem to be holding onto their remodeling dollars.

Until recently, the residential construction business was also good in western Canada. "Western Canada in 2007 was probably the bright spot in the North American economy," says Terry O'Neill, president at TRC Distribution in Calgary, Alberta, noting that it's an oil-producing region. Through the first half of 2007, builders were selling houses faster than they could build them, he says, but supply has now caught up to demand. "A lot of people, manufacturers in particular, have looked to western Canada as a place to gain some market share, so though it's been busy, it's been increasingly competitive," he notes.

Jeff Hamar, president/CEO at Santa Fe Springs, Calif.-based Galleher Corporation, describes his market as "ground zero for foreclosures, affordability issues and subprime loans," and the area's new construction business is reflecting that. "The builder business is really soft right now, and I suspect it will continue to worsen, actually. I don't think we're at the bottom of the builder cycle," he says. He sees all the foreclosures as a particular concern, since those homes are often practically new and go back onto the market for below value.

On the other coast, at Wood Pro, headquartered in Auburn, Mass., president/CEO Tony Benvenuti says that business is "very challenging right now. I think there are a lot of things at play," he says, citing the bad news about the stock market and housing market, as well as high fuel prices and home heating oil prices.

While the industry has always looked to remodeling to pick up the slack when new construction slows, in most markets, that doesn't yet seem to be the case. The National Association of Home Builders' Remodeling Market Index for "current market conditions" dropped from 46.2 in the third quarter of 2007 to 40.9 in the fourth quarter.

Bob Gehl, president at Gehl Flooring Supply Inc. in Butler, Wis., says business is consistent, but jobs are smaller. "The existing homeowner who would have new flooring or resanding done has become more conservative, and I think that's because there's a lot on the TV and radio telling people to be scared," he says.

The remodeling news appears to be brighter in some areas. In the Denver market, David Rowe, vice president/general manager at Denver-based Denver Hardwood Company, reports that although new construction has experienced a downturn, the remodeling and commercial business is stronger, while at Cherokee Wholesalers Inc. in Alexandria, Va., Executive Vice President Ray Lynn says that his customers serving area remodelers have seen a "drastic increase" in that segment.

While overall business is difficult, "There's positive out in the market," says Jack Schroeder, secretary/treasurer at The Bahr Company in Romeoville, Ill. "There are people willing to spend money—people willing to buy good products of good value."

Flooding the Market

Although many were preparing for the housing slump to hit at some point, distributors have still been hit hard; they had gotten accustomed to many years of healthy business. During the boom times, the market became flooded with products, and distributors took on additional product lines. Some opened new locations to try to capture all the business, and new distributors entered the market, as well. Now, wood flooring business and prices have plummeted along with the housing market, and distributors are looking for strategies to manage these difficult times.

Distributors' customers are paying close attention to even small price differences, and predictably, to a large degree, price wars have ensued.

"I think distributors are running scared trying to keep their foot in the dealer's doors; they're doing it at any price they have to," says Cherokee's Lynn. "It seems like a lot of the distributors are having a contest as to who can lose the most money. We try not to get involved in that." Lynn says that even though the market is down, his salespeople are focused more than ever on upselling to products that still make a profit.

During the construction craze, many distributors overinflated their inventories and took on new product lines in an attempt to capture every possible sale. Now, they must carefully manage inventory, examining which lines they still need and which offer the best profit margin. Meanwhile, the market is still overwhelmed with all the products that entered the market in the boom times.

"We're seeing tons of manufacturers trying to get their products out there, and I think overall the market is just saturated," says Joe Lawrence, operations manager at Floors Inc. in Birmingham, Ala., adding that it's everything from wood to finish. "They're just coming out of the woodwork."

It's a difficult time for any manufacturer trying to find new distribution. "We've honed down our inventory product lines; because we deal with the middle and upper end of the market, I want to be sure we have all the unique things we need and we don't have four or five that overlap each other," Schroeder says.

Relationships with vendors have become more critical than ever. Distributors are working hard with their vendors to come up with specials or promotions that create more value for their customers.

"One thing that allowed us to be successful is we have stuck by our suppliers—the ones who kind of stuck with us when things were rocking and rolling and we really needed product," Benvenuti says. "We try to reciprocate that now that it's slow and kind of focus in on those particular suppliers."

Of course, distributors are also turning a critical eye on expenses, but that must be done carefully. If distributors can't service the customer and they don't provide extra value, they become irrelevant—something they are acutely aware of. Measures like cutting staff or inventory to save money can seem appealing, but they can also backfire.

"Especially when business is very, very slow, our customers don't want to lose any opportunity; it's important for us to get their information and product to them quickly so they can get the job and move forward," says Rick Holden, executive vice president at Willow Grove, Pa.-based Derr Flooring Company.

"I continually tell all of the inside and outside sales staff, 'Our customers have a choice. They buy from the people that they enjoy buying from. Treat them like friends, treat them like family,'" says Mitchell S. Brown, president and CEO at Dallasbased Southern Wood Flooring & Supply.

Capsizing Companies

For some companies, difficult times have already taken their toll. Hoboken's closing in November sent shockwaves through the industry and led to the demise of manufacturer Wood Flooring International. The closing of industry stalwart Roane also took many by surprise. Additionally, the Ohio River Valley's Bruce Wholesale Flooring merged with Jeffersonville, Ind.-based Gilford Flooring in early February, and some small wood flooring distributors, such as Covington Wood & Supply Co. in Birmingham, Ala., have closed in recent months. Other distributors have shut down branches they had opened during the boom times.

"I really question if there's not too much distribution in the marketplace anyway," says David Williams, vice president at Wilmington, N.C.-based Horizon Forest Products. "Businesses sprout up and businesses expand during the boom time, and then you've got to ratchet down and you have too much supply out there," he says.

Despite the perceived oversupply of products and distributors in many markets, the void left by Hoboken's closing did not last long in some areas. By the end of the year, a new distributor, All State Flooring, had opened in Clifton, N.J., with former Hoboken CEO Joel Lefkowitz at the helm. Additionally, distributor Patriot Hardwood Floors and Supply Inc., based in Wilmington, Mass., and owned by Armstrong Industries, opened a new branch in Pompton Plains, N.J., employing many former Hoboken employees.

"Instead of Hoboken, we ended up with two new distributors … my vendors are competing with me now; that's an interesting dynamic," Holden says, adding that some smaller sundries distributors also have sprung up to take advantage of Hoboken's closing.

In the Dallas area, Brown says he was "seriously concerned" when Hoboken entered the market, but Southern Wood's sales didn't drop off, nor did they increase after Hoboken was gone. "There are so many distributors in the Dallas area that it's very difficult for someone new to come in and try to take business from the established companies that already have built a strong relationship with their customers," he says.

Most industry experts consider the closings a bellwether for others in the industry.

"There's no question the middle-market guys—the Roanes of the world—are going to be the first to go," Hamar says. "They're in the biggest trouble, because they have too many costs. They have to compete with the Gallehers and Triwests and Mohawks to some degree, but they're not nimble and flexible enough to be like a small operation." In early 2007, Hamar sold Galleher Inc. to Tokyo-based general trading company Itochu Corporation, giving Galleher the financial fortitude of a company with more than $18 billion in revenues and 600 subsidiaries worldwide. Hamar expects the backing to serve his company well during this downtime. "Our inventories are still at their regular levels, and we have the same resources on the street, so I think the bigger guys will clearly pick up market share and the smaller ones are going to be stressed," he says.

Williams agrees that this downturn will be a financial test for many. "I think unless you're a well-financed distributor—and I mean well financed—who can get through this time, 2008 could be a serious year for you. Cash flow is going to be a very big challenge for most of these distributors," he says.

At Armstrong Flooring Products N.A., President/CEO Frank Ready says that, like manufacturers, distributors must have the financial strength "to not only survive, but thrive in these difficult times. Similar to manufacturers, they have to use this time to take share."

Some distributors have begun to see their customer base erode due to the housing slump. In Birmingham, Ala., "I see a lot of our contractors, especially the ones who weren't well known or haven't run their businesses very well over the years, falling to the wayside," Floors Inc.'s Lawrence says. "The guys that are embedded and have very good reputations are still working, but not like they want to be. I've been told by most of them it's week to week if they have work or not— from the biggest guy to the smallest."

Gehl has noticed the same in his Milwaukee metro market: "We've definitely watched some of them go away already. The big guys are still here, but a lot of the little guys who popped up because of the boom—I haven't seen them in over a year."

Staying Afloat

As the industry matures, experts have long predicted consolidation at all levels, including distribution. In recent years, they've been proven right. In the last three years, Denver Hardwood Company has grown substantially, acquiring distributors in the Pacific Northwest, Georgia and, just last November, in St. Louis, giving it a total of 13 full-service distribution locations.

Denver Hardwood's Rowe says the company is "looking to expand its footprint geographically." While the company maintains substantial decision-making at the local level, the diversity offers advantages beyond the obvious buying power, including the opportunity "to evaluate a broader array of product offerings and also diversify geographically in terms of market swings," Rowe explains.

At the end of 2006, Baillie Lumber, the parent company of distributor Horizon Forest Products, bought Richmond, Va.based Long Floor Supply and Beltsville, Md.-based Long Floor Distributing LLC, combining them into Long Floor, and the management of Horizon and Long Floor have since merged.

Joining forces offers several advantages, Williams says. "If you combine the operational costs of the two, that's a huge advantage, and the other advantage is just our purchasing power now. Being one of the largest distributors on the East Coast with eight locations provides us with some purchasing opportunities," Williams adds.

Another distributor with significant purchasing power on the East Coast is Wood Pro. In 2006, the company headquartered in Auburn, Mass., quietly acquired Jacksonville, Fla.-based Custom Wholesale Floors Inc., creating a total of 12 distribution locations. "We looked at it as an opportunity to expand our coverage area quicker to make us appealing to customers as well as suppliers," Wood Pro's Benvenuti says.

Most people expect that the current economic climate will accelerate the evolution to fewer, bigger players in the industry. "It's no secret that there are a number of, not only distributors, but a number of manufacturers going through troubling times, and I wouldn't be surprised if we see some consolidation on both fronts—either acquisitions or mergers, or distributors and manufacturers going out of business," Rowe says, echoing the sentiments of many.

No Clear Path

The changes can add to the confusion in what most see as the continual marginalization of the traditional distribution channel. Dealers buying directly from overseas, consumers buying from outlets such as Lumber Liquidators, consumers buying product online, manufacturers bypassing distribution and selling direct, and manufacturers with their own distribution are just a few phenomenon concerning today's distributor.

"The never-ending challenge is to demonstrate value to your customers every day. When value is created customer relationships are enhanced and supplier relationships strengthened. When value is not added, both the retailer and supplier look for a better way," Ready says.

Leading the way among manufacturers with their own distribution are floor covering giants Mohawk Industries and Shaw Industries Group Inc. Last July, Dalton, Ga.-based Mohawk announced it was purchasing four wood flooring plants from Columbia Forest Products, which had been a Mohawk supplier. Then, in September, Dalton, Ga.-based Shaw, which is a subsidiary of Berkshire Hathaway, announced it was acquiring The Anderson Family of Companies. Although Shaw and Mohawk have their own vast distribution networks, bypassing traditional distribution altogether, each said they would continue to support the newly acquired companies' existing distribution networks. (For more, see "TK" sidebar on page TK.)

Distributors are keeping a cautious eye on the pair, but many feel comfortable operating in the shadow of the giants. They point to strong relationships with existing customers, product knowledge and other service attributes as their advantages compared with the large manufacturers.

At Emerson, Peterson doesn't fear the impact from the biggest manufacturers, explaining that one of the negatives to the companies' being so large is they can easily lose track of their customers and their customers' needs. He points to the example of the Armstrong wood flooring brands. "There are tons of people that have enjoyed being a competitor of Armstrong … because they can get closer to their customer and look at his needs," Peterson says.

Rowe says Mohawk and Shaw have had an impact on the marketplace, but "they do have their challenges with regards to quality issues with various products, and they'll have to sort through those if they want to be a stronger competitor," he says.

Hamar predicts companies like his will have to get even bigger to compete, creating "mega-independent distributors," and that those distributors will still have the advantage of a better understanding of the local market and customer relationships.

Some traditional wood flooring distributors have noticed they are increasingly competing with general floor covering distributors for manufacturers' attention. They are quick to point out their own advantages, though: Wood flooring will always require more knowledge than other floor coverings and retailers are eager for someone who can educate them on the product. Wood flooring specialists are capable of providing that.

"I think from a manufacturer side, you see them wanting to go to the bigger, more diversified floor covering people, thinking that's nirvana—because they're big they can finance receivables, they can finance inventory, they can bring in and make product launches and do displays and all that. That's great, but then I see a lot of these bigger guys being everything to no one … you lose a lot of that personal relationship."

Some wood flooring specialist distributors feel immune, to a certain degree, to the impact of the industry's biggest prefinished companies.

In Gehl's Milwaukee metro market, there are plenty of highly skilled wood flooring craftsmen, and they do a good job at educating the customer about the differences between prefinished and unfinished flooring, he says. Even if the big prefinished companies dominate the industry, he says, "there still will be so many people who look at what they have to offer and say, 'That's not even remotely what we want.' A lot of the homes we get into—these floors are very expensive and custom."

The Road Ahead

Although wood flooring distributors expect 2008 and probably 2009 to be challenging years that filter out the weaker players, most feel positive about their place in the future of the wood flooring industry. They are confident that, as long as they continue to add value to their customers through their exceptional service and expertise, they will outride the economic storm and continue to be a vital part of the industry for many years to come. And, perhaps most importantly, they feel overwhelmingly positive about the future of the wood flooring industry as a whole.

At Derr, which has been in business for 96 years, Holden puts the current market conditions in perspective. "I think we're on a path to have a good long-term run," he says. "As my grandfather used to say, "Now you're planting the seeds for when things get better,' and I think that's true."

The View from Second PlaceIndustry reports now place Dalton, Ga.-based Shaw industries, which acquired Clinton, S.C.-based The Anderson Family of Brands last September, as the second-biggest hardwood flooring manufacturer. Hardwood Floors spoke with Rick Knowles, vice president of residential hard surfaces at Shaw. HF: What was the motivation for the Anderson acquisition? RK: Shaw wants to be a bigger player in the wood industry. Anderson was our choice in terms of acquisition because of a lot of reasons … To me, one of the neat things about Anderson is that it's a company in the last 10 years that's completely reconfigured itself. Ten years ago, they had a lower-middle priced standard line of wood flooring, and then they really led the industry down this whole path of style and design and textured visuals. When you look at their innovation and marry that to the financial strength and systems strength that Shaw has, it's a pretty powerful relationship that could be developed over time. HF: Will product lines be merged? RK: No, not at all. The entire Anderson management team is still in place at Anderson and they still run their company. We've got a lot of customers that buy carpet from us that don't buy Anderson wood, and we're obviously looking to leverage those relationships and create more Anderson customers for them and their distributors. But in terms of the operation of the business and the way the product goes to market through the distribution channel, that's going to stay just like it is today—Anderson will still go through their distribution base, and they're still in control of who those are and what those relationships look like. HF: What about the speculation regarding Shaw acquiring Armstrong? RK: There's nothing I can say to end that speculation. They're cer tainly for sale, I don't think that's a secret. HF: Has the turmoil in distribution this year affected Shaw? RK: The void created in the marketplace certainly creates opportunities for us. If you look at the Hoboken example, certainly we've picked up business and customers we may not have gotten to as quickly otherwise, for both Shaw and Anderson. By the same token, in excess of $50 million worth of inventory had to be liquidated, so that's created a problem in the marketplace. HF: Are the distribution changes a product of the economy or the natural evolution of business? RK: It's the natural evolution that's been sped up by the economic conditions. The industry will consolidate—how consolidated it gets and how long it takes to get there might be up for debate. If you look at the manufacturers trying to bring products to market, there's only so many distributors to get your goods to the marketplace. Go back 20 years ago, and distributors couldn't get good wood lines because there weren't enough manufacturers; it was pretty much a domestic industry. Today it's just the opposite. The one thing I can tell you for certain—with the change in distribution and however long this economy lasts—is Shaw will still be around when this is over. I think some major retailers who have been bitten when suppliers go out of business are really looking for stability in their relationships, because when you don't have many customers coming through the door, you have to service the ones who do. HF: Is Asian manufacturing still changing the industry, or has that stabilized? RK: I think it's settled down. When we looked at Anderson, that was obviously a big question we had: Where do we make our investments, domestically or internationally? We strongly feel the industry is coming back to U.S. manufacturing. There's going to be a place for products that come in from other parts of the world, but it's not as dramatic as it was three years ago, and I think you'll see it be less dramatic next year than it is this year. You've got so many influences going on right now. In the case of China, there is international pressure toward them to float their currency, and cer tainly the Chinese government has been, over time, taking away the incentives for exporting the products out of the country. Then, the population of China is 1.3 billion people: for every 10 percent that move into the middle class, that's roughly half the U.S. population. As the country evolve s and create a middle class, there's a lot of speculation that they will be a net importing country instead of export country in the wood flooring industry in the next 10 years. There's also been all this negative press about products made over there; I think a lof of consumers are asking where it's made. A lot of people who were bringing the product in have really started to analyze the real cost of doing business there. And, illegal logging is one of the most significant issues. As a world, if we didn't get the illegal logging under control soon, it was going to be too late. HF: What fundamental changes do you see happening in the wood flooring industry? RK: I just think in this next year or two we will see a lot of change in the industry. I think the local distributor's under a lot of pre ssure right now, I think they're having to manage more for cash than profitability. Distributors will acquire other distributors, others will go out of business and you'll see companies like us continue to grow, even in a down market. HF: What about the niche wood flooring distributor? RK: I think the niche wood flooring distributors have a place that's probably as safe as there is in floor covering distribution today. I think they provide a service that companies like us will never be able to provide to the floor covering installer … First of all, the flooring installer is very hard to find and create a relationship with. Those that have gone down that path and have those long-standing relationships have craved out a special place that will be difficult for someone to come in and take away and replicate. |

Profiling Our IndustryEvery two years the NW FA commissions an extensive study of the wood flooring industry in conjuction with Catalina Research. Here are some highlights from the "2007 Wood Flooring Market Profile," which was released at the end of 2007. (An executive summary of the report was sent to all NWFA members; the summary is also available online at nwfa.org. Full copies of the report can be purchased for $3,295 for nonmembers or $2,800 for members.) . The U.S. wood flooring market declined in 2006 and 2007 after two decades of double-digit gains. The downturn began in the third quarter of 2006. . The downturn hurt wood flooring more than other floor coverings bec ause of wood flooring's above-average reliance on residential markets. . The U.S. housing market is forecast to hit bottom in 2008; it normally takes six to 12 months for an upturn in flooring demand to occur after housing rebounds. . The value of U.S. wood flooring sales (shipments minus exports plus imports) was estimated to decline to $2.5 billion during 2007, a 5.0% decrease from the previous year. . Square foot sales for 2007 were estimated to drop to 920 million square feet, an 11.8% cut compared with 2006. . Sales declined on a dollar and unit basis in 2006. This followed a decade of double-digit dollar gains and a 7.7% annual compound growth rate for square foot sales. . In 2005, wood flooring accounted for 10.8% of total dollar floor coverings sales and 4.0% of total square foot sales. This compares with about 8.0% and 3.0%, respectively, in the early 1990s. During 2007, wood flooring's share was estimated to hold at 10.8% of total floor coverings sales, while declining to 3.6% on a square foot basis. . Engineered products were estimated to account for 46.6% of total U.S. wood flooring square foot shipments during 2007, up from 42.1% in 2004. . In 2006, Home Depot and Lowe's were estimated to have sold $845 million of wood flooring or 19.8% of total wood flooring retail sales. This compares with an estimated 16.8% in 2002. . During 2007, Lumber Liquidators' hardwood flooring sales were estimated to reach $279 million or 6.9% of total U.S. hardwood flooring retail sales. This is up from 1.6% in 2002. . In 2006, Mannington, Mohawk and Shaw were estimated to have accounted for 15.0% of total U.S. wood flooring manufacturer sales. This is up from only about 3.3% in 2002. . The top four competitor s' share (Armstrong, Shaw, Mohawk and Mannington) was estimated to be 58.0% during 2007, up from about 51.0% in 2002. . Imports were estimated to account for 11.2% of dollar manufacturer sales (shipments minus exports plus imports) during 2007 and 14.9% of square foot sales. This is up from 3.7% and 5.3%, respectively, in 2002. . In 2006, average import prices were only $1.73 a square foot, compared with $2.61 for U.S. manufacturers. . When demand for wood flooring rebounds, sales could increase at relatively sharp rates. U.S. dollar wood flooring sales (shipments minus exports plus imports) are forecast to increase at a 7.5% compound annual rate between 2007 and 2012. Sales are projected to climb to $3.5 billion and 1.1 billion square feet, accounting for 12.7% of total floor coverings dollar sales and 3.9% of total square foot sales. |

Figuring It Out

Sourcing Product

Of the contractors surveyed (more than one answer possible) ...

81% buy from specialty wood flooring distributors

35% buy from general floor covering distributors

37% buy from a big-box store

34% buy direct from manufacturers

At a big-box store, contractors say they are most likely to buy (in order of likelihood):

- installation tools

- adhesives

- wood flooring

- finish

- abrasives

- sanding equipment

At a big-box store, distributors think their contractor customers are most likely to buy:

- wood flooring

- installation toolsadhesive s (tied)

- finish

- abrasives

- sanding equipment

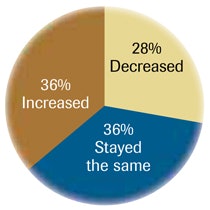

Contractors' Business in 2007 ...

In 2006...

• 42% of contractors indicated that busine ss increased

• 35% stayed the same

• 23% decreased

Distributors' Business in 2007 ...

In 2006 ...

• 75% of distributors indicated that business increased

• 19% stayed the same

• 6% decreased

Alternate Avenues

Of the distributors surveyed ...

50% said their business has been affected by big-box stores such as Home Depot and Lowe's

50% said they have not been affected by big-box stores

14% sell some product online

Plastic Products

Of the distributors surveyed ...

63% sell a laminate product

37% do not

59% expect laminate to grow

41% do not

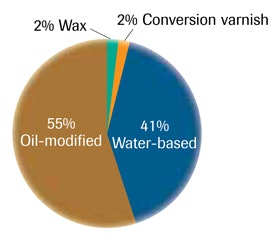

Finish Used by Contractors

In 2006, contractors said ...

• 56% oil-modified

• 38% water-based

• 4% moisture cure

• 2% conversion varnish

• <1% wax

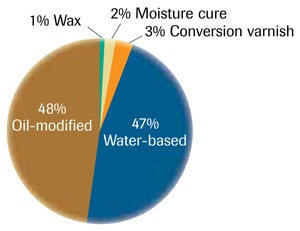

Finish Sold by Distributors

In 2006, distributors said ...

• 44% water-based

• 48% oil-modified

• 4% conversion varnish

• 4% moisture cure

• 0% wax

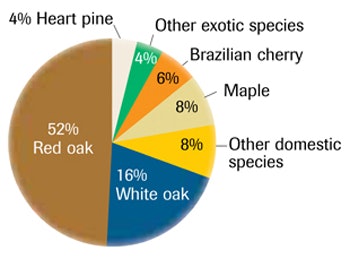

Species Installed by Contractors

The contractor numbers in 2006 were ....

• 52% red oak

• 16% white oak

• 10% maple

• 8% Brazilian cherry

• 5% other exotic species

• 5% other domestics (cherry, ash, birch, beech)

• 4% heart pine

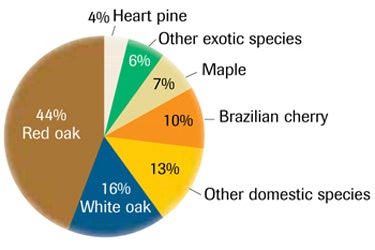

Species Sold by Distributors

The distributor numbers in 2006 were ....

• 36% red oak

• 18% white oak

• 17% other exotic species

• 10% Brazilian cherry

• 9% maple

• 8% other domestics

• 3% heart pine

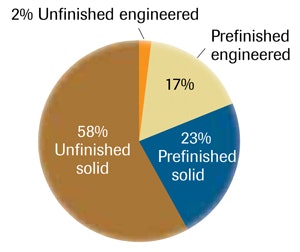

Contractors Are Installing ...

Contractor numbers in 2006 were ...

• 68% unfinished solid

• 21% prefinished solid

• 8% prefinished engineered

• 3% unfinished engineered

Distributors Are Selling ...

Distributor numbers in 2006 were ...

• 48% unfinished solid

• 29% prefinished engineered

• 22% prefinished solid

• 1% unfinished engineered

How Contractors Spend Their Time

What They Do ...

In 2006, contractors divided their business, on average ...

• 55% sanding/finishing/refinishing

• 45% wood flooring installation

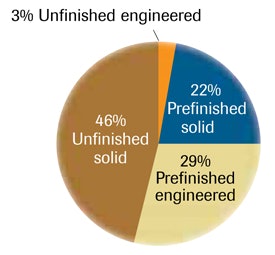

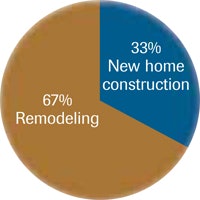

Brand New vs. Renew

In 2006, contractors divided their business, on average ...

• 62% remodeling

• 38% new home construction

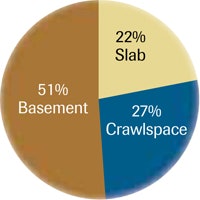

Subfloors Are ...

In 2006, contractors installed over ...

• 56% basement

• 28% crawlspace

• 16% slab