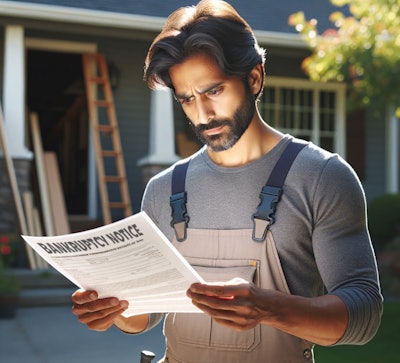

If a customer files for bankruptcy after you’ve installed their floor, the odds of receiving payment significantly decrease. However, if you hold lien rights, there is still a chance of collecting payment.

Here’s what to know.

Know the type of bankruptcy

If your customer merely tells you they are “filing for bankruptcy,” it means nothing. They must actually retain an attorney and file a case in federal bankruptcy court. All listed creditors will then receive a notice of the bankruptcy case from the court. There are three primary types of bankruptcy cases: Chapter 7, Chapter 11 and Chapter 13. Construction businesses most commonly encounter Chapter 7 cases, wherein a trustee seeks to liquidate the debtor’s property to pay creditors. Frequently there are no assets, or the assets are exempt from collection efforts. In those cases, creditors without a “secured claim” usually collect nothing. A “secured” claim means the creditor holds a lien against an asset, typically real estate. After a Chapter 7 case is filed, an “automatic stay” against collection action is imposed, and creditors must immediately cease all collection efforts and must follow the court rules regarding “claims.”

File a “Proof of Claim”

The first step for a creditor facing a bankruptcy case is to assess whether a “Proof of Claim” may be filed. This is a form filed with the court stating the amount and nature of the debt, including whether you hold lien rights. If the Chapter 7 debtor is an individual, there will usually be no assets to pay unsecured creditors, and creditors without liens will not even be allowed to file a Proof of Claim and will almost certainly receive nothing. If an individual debtor successfully completes the bankruptcy process, all unsecured debts will be “discharged” and cease to exist.

However, in Chapter 7 cases filed by a business entity, while the automatic stay will prohibit collection action during the bankruptcy case, after the case is concluded, unsecured creditors could resume collection efforts against the entity.

Preserve your lien rights

Lien rights may not be discharged in bankruptcy, and the contractor holding them should file a Proof of Claim as a secured creditor. One of my clients held a mechanic’s lien against a customer’s house for flooring work. The customer filed for Chapter 7, and we filed a Proof of Claim. The customer discharged my client’s contract claim against them personally, but the lien claim was not discharged. The customer was surprised to learn that we could still foreclose on their home, and eventually my client was paid in full.