Accounting is a task many people would rather not think about. Just mention it and their eyes glaze over. Many wood flooring contractors are no exception.

They may be too busy worrying about whether Mrs. Smith's floor is installed on time to bother dealing with the company's financial statements. But even as Mrs. Smith writes that check, the wood flooring contractor could be losing money if he doesn't have an effective accounting system.

An adequate accounting procedure is mandatory so that financial records can be kept for income taxes. However, it should also be a tool for running your business that's just as important as your nailer or big machine. Your accounting system tells you whether or not you're making money. Within that, it can tell you where your expenses are too high, or where your sales are lacking. If you have an organized way of knowing what your expenses are, it can help you estimate jobs, since you know the real costs of every job, not just how much you spend on wood and other materials.

Knowledge of the basic fundamentals of accounting and the ability to understand your business' financial statements can help give you a competitive edge. This doesn't mean every contractor should trade in his nailer for an accounting degree, but a basic understanding of your books is essential in making astute financial decisions.

What's involved in your company's "books?" Every basic accounting system should have a balance sheet and an income statement. The balance sheet shows your company's value. You also need an income statement. That records your sales and expenses, and then a resulting loss or profit. The profit or loss goes into the equity section of the balance sheet and increases or decreases the value of the company. All accounts maintained by the business are collectively referred to as the general ledger. The formal index of these accounts is referred to as the chart of accounts, and even for a small business, the chart can easily contain more than 100 accounts. First, let's look at the big picture.

Income statement

The profit and loss (P&L) statement tracks the profit-making operations of the business, showing whether it has produced a profit or taken a loss for a specific period. It is also called the income statement. It is computed as follows:

Income statement = revenues - expenses

That results in either net income or net loss for a specific time period. The income statement for a small business usually follows this format:

• Net sales (gross sales - returns and allowances) is the first item. This is simply the amount of money taken in from operations less amounts returned to customers.

• Cost of goods sold or cost of sales is second. This is the total cost of materials or other costs that relate directly to making the item or providing the service. For a contractor, examples would be wood flooring, nails, abrasives, finish, etc., but not machines, insurance, etc.

• Gross profit (net sales - cost of goods sold) is the next item. This amount reveals how well the business is doing at its primary activity. The gross profit figure is usually followed closely and can also be expressed as a percentage of total sales. A small change in this percentage can have a significant effect on your bottom line.

• Operating expenses include general, selling and administrative expenses. These are expenses indirectly related to producing income. Some examples are salaries of office personnel, rent, utilities, insurance and depreciation of assets, such as your machines and vans.

• The income and expenses categoryincludes income and expenses thatare auxiliary to the business. Themost common examples are interest,dividend income, and gains or lossesfrom the sale of assets.

• Income tax expense is shown next.

• Net income or net loss is the final amount shown on the income statement.

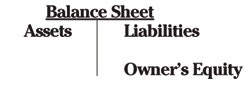

The balance sheet

The balance sheet reports the assets, liabilities and owner's equity of a business. Basically, it tells you what the financial condition of the company is at a certain point in time, typically at the end of every month, quarter and year. The balance sheet formula is:

assets = liabilities + owner's equity

Typically, a balance sheet is laid out like this:

The two halves must be equal, or in balance, at all times, hence the name balance sheet. The individual parts are:

• Assets include items such as cash,accounts receivable, inventory, prepaid expenses, equipment and buildings.

• Liabilities are the amounts owed bythe business for things such as supplies, wages, loans and taxes.

• Owner's equity is the amount of money the owner has invested in the business, plus the net income or net loss from the income statement. Assets and liabilities may be current (expected to be turned in to cash or paid within one year) or non-current (expected to be held or paid off in one year or longer).

Debits and credits

Accounting is based on a double-entry system of bookkeeping; it tracks both the business' assets and the sources of those assets. Every transaction recorded must affect two or more accounts. For example, say you ran to your distributor and paid him $100 for finish. This transaction needs to be recorded as a $100 increase in the assets account "inventory" and a $100 decrease in the asset account "cash." Now say that your distributor knows you pay your bills, and he lets you take the finish on credit. Again, the asset account "inventory" increases, and this time the liability account "accounts payable" increases by the same amount.

Accountants keep track of these increases and decreases as debits and credits. When most people think of credit, they think of it as a type of loan— whether it's from a bank, credit card company, or your distributor. They think of a debit as a type of credit card. For accounting purposes, it is best that you try to completely erase those ideas from your mind, as they have almost nothing to do with your accounting books.

In your books, debits go on the left side and credit on the right side. To visualize this, imagine every account as a capital letter "T," with the debit entries on the left and the credit entries on the right. The amount of debits and credits must always be equal.

This is how debits and credits in your accounting books work:

• Increases in assets: recorded as debits

• Decreases in assets: recorded as credits

• Increases in liabilities and owner's equity: recorded as credits

• Decreases in liabilities and owner's equity: recorded as debits.

For instance, say you had a job padding and recoating a room. You went to the customer's house, completed the job that afternoon and the customer paid you immediately. The entry to record this transaction would be to debit "cash," an asset account. The offsetting entry would be to credit"sales," a revenue account. Since you collected cash and sold a service, both accounts would be increased. The entry to record the purchase of supplies for the job in this example would be to debit supplies and to credit cash (crediting this account decreases the amount in it).

All business transactions follow these basic debit and credit procedures. Although this is a very simplified pictureof the accounting process, these fundamentals allow you to determine the financial position of your business.

General journal and general ledger

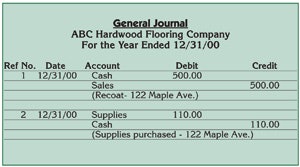

Transactions are initially recorded in chronological order before being transferred to their specific accounts. This initial recording is done in the general journal. In the example above, there would be two separate general journal entries: one to record the sale of services and another to record the purchase of supplies.

The general journal shows the debit and credit effects of each transaction. Typically, the general journal has aspace for the date, account title, explanation of the transaction, a reference column and two money columns, one for debits and one for credits (see sidebar). The general journal shows the specific effect of every transaction and helps to prevent or locate errors since debits and credits must be equal for each transaction entered.

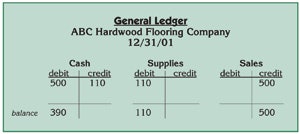

The entire group of accounts maintained by the business is called the general ledger. All asset, liability, equity, revenue and expense accounts used by the business comprise the general ledger. General ledger accounts are usually arranged in order of the financial statements beginning with the balance sheet. First in order are asset accounts, followed by liability and equity accounts, and finally revenue and expense accounts. After transactions are posted in the general journal, the amounts entered for each transaction are then carried to the specific account in the general ledger.

Going back to the previous example, say you are paid $500 to pad and recoat the floor and you pay $110 for the supplies. To record this transaction, you would take the following steps (see sidebars):

1) Enter it in the general journal:

a. To record the income, debit "cash" $500 and credit "sales" $500

b. For purchasing supplies, debit the "supplies" $110 and credit "cash" $110.

2) Carry these over to the specific accounts of the general ledger:

a. Debit the "cash" account of the general ledger by the $500 of income

b. Credit "sales" $500

c. Credit the "cash" account $110 paid for supplies.

d. Debit "supplies" by the $110 paid.

The general ledger then shows the "cash" account as having a $390 debit balance. The "sales" account shows a $500 credit balance and the "supplies" account has a $110 debit balance.

This basic process is followed for all transactions of the business. The balances in each general ledger account are then used to generate the financial statements of a business.

Accounting software

Accounting and bookkeeping used to be a very laborious task since all entries had to be manually entered into the general journal and then posted to the general ledger. From the general ledger the various accounts were manually totaled and carried to the appropriate financial statement. This was quite a daunting task for even a small business. Thanks to technology, those days are gone and many accounting and bookkeeping software options exist.

Considering the needs of your business is the first step toward purchasing your accounting software. Talking to other small business owners may also be a valuable tool. Perhaps the best advice comes from a certified public accountant who's familiar with these programs and can help you determine your accounting software needs.

Accounting problems can snowball and turn into major nightmares, so it is best to have a set system right from the start, whether it's the right accounting program or hiring an accountant. As your business grows, you'll be armed with the information you need to continue in the right direction.