Hello, Keith Long here to continue along the vein of thought started in the last post on business.

I had mentioned a book that has helped me become more clear on retirement planning, The Richest Man In Babylon by George S. Clason. In my opinion, it contains many pearls of wisdom, waiting to be discovered by those who read and understand it.

“Money only makes us more of what we already are.” Volumes could be written on that statement.

I was fortunate to have grown up around several great mentors. These people have gently guided me throughout my life, and helped me become the person I am today. They’ve given me advice, and recounted stories from their own life, yet have always left me free to make my own decisions, to learn my own lessons. One of the common threads that seems to run through their philosophies on life is, “Money only makes us more of what we already are.” Volumes could be written on that statement. When we last left off, I had touched on the fact that I prefer real estate for an investment vehicle. I like its long-term, consistent stream of wealth that can be enjoyed in retirement. Here are some of the reasons why:

- 1. If purchased reasonably, it provides great cash-on-cash return.

- 2. It only has to be purchased once, yet once acquired, brings in income on a regular basis indefinitely.

- 3. Over time, real estate has traditionally increased in value.

- 4. Over time, rents can be increased to keep up with the price of inflation.

- 5. If a person so chooses, rentals can be put under property management.

- 6. It provides a service for those who choose to rent instead of own property.

- 7. It can be put in trust.

- 8. It can be passed down to future generations.

Although some of my mentors own some stock, others don’t own any at all. They asked me questions such as, “What control do you have over whether the price of a stock goes up or down?” “What is the cash flow with stocks?” “If a stock does pay a dividend, what is the cash on cash return?” “If you were to ask yourself the same questions about investing in real estate, how does it measure up to investing in stocks?

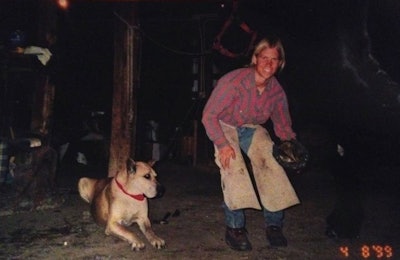

I started digging into these questions in my mid-20s. My wife Robin and I were newlyweds, and we were making decent money. She was managing a horse ranch outside of Fort Collins, Colo., for a Denver businessman, where she did everything: breeding, foaling, feeding, cleaning, training, exercising, grooming, hoof work, vet work, transporting, et cetera. The 640-square-foot (70 square meter) home where we lived on the ranch had one bedroom, and it was so small that we had to push, push, push on the bedroom door to get it to closed past our not-very-big bed. At that time, I shod horses:

My reason for telling you this is that we were just regular folks. When we left our parents’ homes, we weren’t given anything monetary. “You’ll just have to figure it out,” is a piece of advice I remember being given. “The most fun part of wealth is making it,” is another. Actually, I’m glad for that. It has been a fun challenge figuring out how to get ready for retirement.

One thing I did along the way was read a book called Rich Dad, Poor Dad by Robert T. Kiyosaki. He has since branched out and authored many books on a variety of business subjects. He has some non-traditional paradigms as far as business strategy goes. Although I don’t subscribe to all his ideas, his Cashflow 101 board game really helped me get clear on where different investments can potentially take a person. In my opinion, it’s a great way to practice in a game setting and get comfortable with investing without having to risk real money.

It’s been 15 years ago, but I imagine the game can still be ordered if there’s an interest. It was spendy compared to other board games, but by my way of thinking a great value. Knowing how much it helped me to formulate positive ideas that have allowed me to get out of the ‘rat race’ in real life, I’d buy it again.

In kindergarten, some kids are happiest building structures with the blocks in the room, while others are happiest kicking said structures down. There are dozens of objections to investing in real estate. I’ve heard it said that an objection is merely a question in disguise. If you have questions about any of my blog posts, feel free to contact me. I’m not trying to make anyone do anything. However, I am trying to shed light on what I have done, just as people did for me starting 15 years ago, and still do today.

I keep hearing people say that this is a free country, so your questions, comments, and feedback are welcome. I intend for the next blog post to be about using a custom inlay as a marketing tool.

Stay sharp!