and enthusiasm for remodeling took on a feverish pitch. Best of all, wood flooring was the material of choice for this building boom.

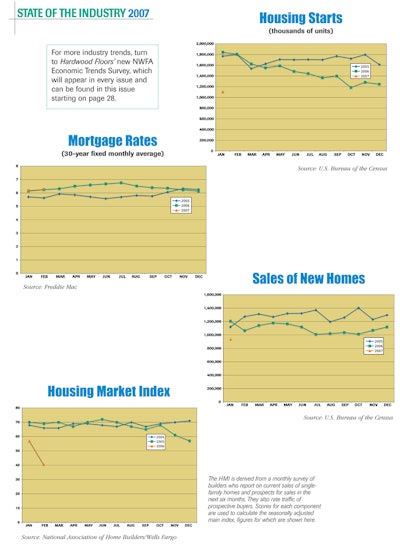

The good news is that wood flooring is still overwhelmingly the preferred flooring. The bad news is that in 2006 and so far in 2007, the housing and remodeling markets have hit the slowdown many experts said was inevitable. Housing starts in 2006 were down almost 13 percent from 2005, and experts say that the increase in interest rates has put a damper on renovations, as well. Although the current slump wasn't a shock, it was certainly unwelcome.

Last month, there were also sharp declines in both the U.S. and Chinese stock markets. Experts have predicted that the construction market won't help the sagging economy until at least the end of the year.

Along with the challenge of the current slowdown, the wood flooring industry has also been adjusting to a major change in the market. During the recent boom years, the number of wood flooring suppliers and products exploded. Those numbers included a huge influx from abroad, with much of the flooring appearing from Asia, especially China. While some domestic manufacturers quickly took advantage of Asian production by private-labeling those imported products, others still bristle at just the mention of Asian flooring. The wood flooring industry here is still adjusting to all these competitors in the marketplace, and now, it has the housing market slowdown to contend with, as well. As these forces combine, many experts feel the wood flooring business is irrevocably, fundamentally changing.

Here at Home

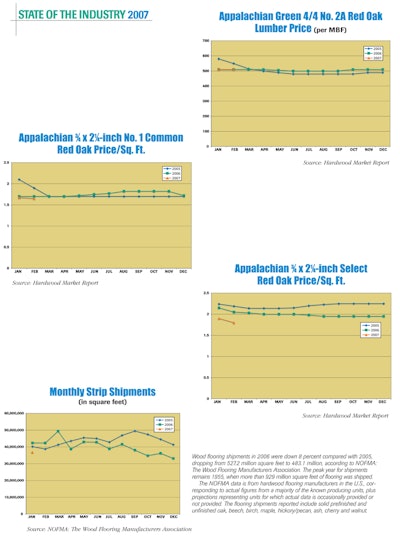

The unfinished domestic wood flooring business tends to follow a somewhat predictable cycle between tighter supplies creating higher prices and oversupply leading to lower prices. Unfortunately, the current housing slump seems to be exacerbating a current state of oversupply and the lowest prices since early 2003. Strip shipments in 2006 fell about 10 percent from 2005, although 2005 was the best year recorded since 1966, when the Federal Housing Authority approved wall-to-wall carpeting as part of a new-home mortgage, according to figures from Memphis, Tenn.-based NOFMA: The Wood Flooring Manufacturers Association. Currently, manufacturers of those products are being squeezed—their expenses are the same, but their prices remain at rock-bottom lows (see charts on page 92).

"We're keeping our product moved, but we just don't have any margin," says Bob Haggard, secretary at Hassell & Hughes Lumber Company Inc. in Collinwood, Tenn., and president of NOFMA. "We're working just as hard as we were two years ago when we were making 12 percent, and now we're making nothing."

"There's just a lot of it available right now at a reasonable price," agrees Pete Miller, president at Middlefield, Ohiobased Sheoga Hardwood Flooring and Paneling.

Neil Poland, president at Johnson City, Tenn.-based Mullican Flooring, anticipates a "very rough start" to the year for the unfinished business. "Some of the domestic production has to correct itself before the unfinished part of the industry will get back to reasonable margins," he says.

The market is also difficult right now for prefinished flooring, although the margins for factory-finished flooring are usually more protected than those of the commodity-driven unfinished strip business.

"Market conditions are tough," says Frank Ready, president and CEO of Lancaster, Pa.-based Armstrong Floor Products N.A., adding that the company took steps to reduce spending in anticipation of a challenging 2007. "However, we also see this period as a great opportunity to help our customers grow their business during tough times," he says, adding that the company is increasing its hardwood advertising to include television this year.

Rick Knowles, vice president of hardwood sales at Dalton, Ga.-based Shaw Industries, says that Shaw's hardwood business is "growing pretty substantially," although not as fast as the company's aggressive plans call for. "Housing is very slow and retail is very slow, so we're not getting as much as we like, but we're probably getting more than most are," he says.

"It is soft out there," says Jason Strong, vice president of sales for Medley, Fla.-based BR-111. "We're used to seeing really big double-digit growth, and now we're seeing double-digit growth, but it's not as great as it has been the last couple of years."

At Delson, Quebec-based Goodfellow Inc., demand is still good, says Mike Gagne, vice president of flooring. "We actually sold more square footage last year than the year before, but prices are down, so dollar-wise, our numbers were off a little bit," Gagne says.

Imported Impact

The slump in the housing market is a drastic change for manufacturers that had grown accustomed to relatively easy sales during years of the building boom. While that slump should be relatively short-term, manufacturers are also adjusting to the greater, more fundamental shift due to globalization. Its effects, specifically those from Asian manufacturing, continue to transform the playing field in the industry.

Unlike several years ago, Asian manufacturing and the influx of those products into North American markets have become widely accepted. While there is little unfinished wood flooring imported from Asia—the logistics make it impractical—Asia has become a major supplier of prefinished products, particularly engineered wood flooring. While some of the products are sold directly to North American distributors (and some Asian suppliers bypass distribution altogether), vast amounts are also imported by the industry's leading wood flooring manufacturers, which are taking advantage of the modern technology and low labor costs overseas.

When the imports first arrived on the scene, some price points—particularly for entry-level products—plummeted. More recently, however, there haven't been drastic shifts, industry experts say. In fact, many are looking for prices on wood flooring manufactured in China to increase in the near future, for several reasons. Some note that the strong effort by the Chinese government to support wood flooring manufacturing has now resulted in overcapacity. Additionally, pushed by industry groups, the U.S. Customs Service has made a concerted effort in the last 18 months to make sure all imported wood flooring is put under the correct classification in the U.S. Harmonized Tariff Schedule, a move that in many cases puts a 3.2 or 8 percent tariff on products that previously had none. On top of that, the Chinese government recently made changes to its own taxes—in May 2006, it implemented a 5 percent consumption tax to slow down sales of solid wood flooring in China, promoting sales of engineered flooring. This 5 percent tax was also applied to export sales of solid flooring. Then, in November 2006, it implemented an additional 10 percent tax to solid wood flooring made from Chinese wood and reduced the VAT rebate on engineered flooring from 13 percent to 11 percent. As of January 1, it repealed the rebate it had previously given on the 11 percent VAT tax charged on engineered wood flooring.

Those changes are welcomed by many domestic producers who protest that Chinese manufacturers don't "play by the rules." They point out that even the vast difference in labor costs doesn't fully account for the low pricing available out of Asia and cite the Chinese government's various methods of subsidizing manufacturers there as unfair.

Still, most observers in the industry now say that Asia's participation in the wood flooring market is permanent and should be accepted. In fact, many see benefits to the industry. As prices at the entry level have dropped, "there's a segment of the population that can afford hardwood floors now; you have a bigger audience," Goodfellow's Gagne says, adding that higher-end products such as hand-scraped flooring also are now more affordable.

Peter Barretto, president and CEO at Mississauga, Ontario-based Torlys Inc., says the wood flooring market here has permanently changed for the better. The North American market focused on only oak for years while the rest of the world used new species and new types of products, he says. "The world was looking at North America as this kind of protectionist island. And now, over the last five to 10 years, it's much more open to worldly trends," he says. "We are good competitors and businesspeople here, so we should be free of protectionism and embrace all these things."

Being open to worldly trends has meant an explosion of options for consumers and SKUs for manufacturers. "The engineered segment of the industry is just much more highly fragmented than it was, say, 10 years ago, and that's primarily driven by the imports. There are so many more shapes, sizes, thicknesses and textures available now that it's a worldwide-sourced product category," Shaw's Knowles says. That's good for the consumer, he says, because of their many style options. "From a distribution standpoint, for those who are good at finding a niche, there is some money to be made," he adds.

For many manufacturers, taking advantage of Chinese manufacturing has been critical to their success. "For engineered products, China has been a huge opportunity for us. It has really allowed us to expand our business more rapidly with more product types and styles," says John Himes, president at Burlington, N.J.-based Wood Flooring International.

Growing Pains

Although the Asian manufacturing base has begun to mature, that doesn't mean that doing business there is trouble-free. While some of the manufacturing is high-quality, using the latest equipment and technology, there are still plenty of horror stories regarding everything from undesirable moisture contents to finish problems. Many people who tried buying from Asian manufacturers were burned and haven't tried again.

Others have found buying from Asia too much of a hassle. Goodfellow handles hundreds of containers a month from overseas, Gagne says, giving the company the expertise to deal with the complicated logistics of sourcing, duties, financing, shipping and other issues that come with importing products. That expertise has led to a growing part of Goodfellow's business that is brokering Asian products for other companies, Gagne says.

Torlys' Barretto predicts that the Chinese market will continue to improve. "If you look at these companies, they're buying state-of-the-art Italian, German, Portuguese and Spanish equipment with the latest technology and diamond tooling and tolerances that are unbelievable," he says. "They are beautiful Ferraris, but you need to learn how to drive all these things," he adds.

At BR-111, the company's products do include some Chinese-manufactured products, but "we're walking before we run there," Strong says. In fact, the company is looking to the growing Chinese middle class as a potential market. "We're actually looking at China not as a threat but as an opportunity … We're positioning ourselves so we can be ready to sell our brand over there," he says, adding that Chinese consumers "idolize" brands.

By all accounts, construction in China is going at breakneck speed. The country's own needs may at some point be a factor affecting the flow of Chinese wood flooring into this market, says Mullican's Poland. "Their domestic economy is growing rapidly, and they need a lot of the Chinese flooring production for their own market; wood flooring is very popular over there," he says. (For more, see the sidebar "China: A Look Inside" on page 76.)

Competitive Nature

While some manufacturers here seem intent on wishing the imported products away, others have aggressively planned to compete in this new marketplace. At St-Augustin-de-Desmaures, Quebec-based Preverco Inc., a strategy was developed two years ago to compete with imports as well as prepare for an inevitable slump in the housing market, says Julien Dufresne, vice president of sales and marketing. That planning is now coming to fruition, with a new state-of-the-art engineered flooring plant, new types of products, and a new image and marketing campaign. The threat of imported flooring actually became a benefit, Dufresne says. "The biggest impact for us was that we had to question ourselves more than before … What can we do, are we making the flooring right, can we make it differently?" The innovation makes the company competitive, Dufresne says, and prepares it for even greater success if the Chinese advantage declines in the future—something Dufresne expects.

Lauzon Distinctive Hardwood Flooring in Papineauville, Quebec, is increasing the numbers of SKUs it offers and developing a sales plan that exploits a big advantage over Asian manufacturing: time, says David Lauzon, president. "We don't plan to ask our distributors to increase their inventory, because we know that's their biggest cost," he explains. "We plan to supply a lot of SKUs—a lot of product selection—just-in-time."

Even though Asian imports don't typically include unfinished wood flooring, domestic unfinished strip manufacturers here still feel the heat of competition from the imports. "The threat to them is that people who were otherwise forced to purchase their products because they were the only ones out there now have a choice," says Timm Locke, executive vice president of NOFMA.

Not only are there more choices, but as the industry matures, contractors and consumers are becoming more comfortable with previously unknown products. "We're all just competing against many more products than we used to, and people are a lot more willing to look at other products," says Jim Duke, vice president of sales and marketing at Memphis-based Shamrock Plank Flooring. "They feel safer, more comfortable doing so than they did several years ago." Worrying about the competition is "wasted energy," Duke says. Instead, "We have to maintain our quality, keep our focus on cost controls, and look for niches with products," he adds.

At unfinished strip manufacturer Hassell & Hughes, "We're looking at lots of different angles—things we can do that will keep us competitive or keep us in the game," Haggard says. He looks to updated technology to help manufacturers here. "I think we'll be more and more competitive as time goes on with automation in our own factories; that will keep us from being an industry that gets eliminated," he says. The company's recently installed automated packaging machine is a first step toward better efficiency, he says, adding that technology such as scanners that increase the yields from lumber are also crucial for future success.

Likewise, Wilmington, N.C.-based wood flooring manufacturer Dean Hardwoods, which produces highend, specialty domestic and exotic wood flooring, is focusing on technology to give it an edge. To that end, the company has a brand new "ultramodern, ultra-efficient" plant. While company President Chuck Dean says that he would have made the huge investment regardless, it's especially critical now that Asian products are so prevalent. "If we didn't make the millions of dollars of reinvestment in the plant and equipment, we wouldn't be able to compete," he says. The company's focus on high-end products also positions it well for the future, he adds. "What we do is the top end of everything—because they'll beat you to death for common oak," he says.

Sheoga's Miller says that despite price pressures, a continuing focus on quality is critical to the company's success. "We're not a mass-producing flooring company; we still run our molders on a slow speed ... I think today the quality still sells itself, and that's why we're still successful," he explains.

The Future Market

Most people in every segment of the industry see prefinished flooring continuing to take market share from unfinished products in the future.

"I think what's happening is that slowly but surely unfinished strip—sitefinished flooring in general—is becoming more of a specialty product … So either a company will stay focused on that business, fight it out and be strong in that niche market, or they will expand their horizons and move into other niches that maybe they weren't playing in before," NOFMA's Locke says. An obvious step for unfinished solid strip producers is to make prefinished flooring, he says.

In the prefinished flooring arena, as the market continues to explode with new products, the bar has been raised. Simply offering typical prefinished products will not be enough. Preverco's Dufresne sees that prefinished flooring is becoming more of a commodity item. "So, if you don't add value by offering service, delivery—everything—you're dead," he says. "When the market was booming like the last couple of years, it was real easy to make money, but when the market is turning, it's a different story."

Armstrong's Ready says that the continued commoditizing of the hardwood category is a challenge for the industry. "Focusing on selling 2 1/4 strip is not a winning strategy for anyone long-term," he says. The company is concentrating on advertising and brand recognition—it renamed the Hartco line "Armstrong Hardwood Flooring" to take advantage of the strong Armstrong brand—as well as an aggressive new product strategy providing value-added products, he says. The Armstrong, Bruce and Robbins brands currently account for more than 1,300 SKUs. "New products have been the cornerstone of driving sales in the wood business, and this will continue to be a cornerstone of our efforts in 2007," he adds.

Torlys' Barretto says that while there used to be companies ranging from bad to great, today, due to the intense competition, the bad are fading fast. "They're all great, so how do you compete? Everybody is so good—what I call a sea of sameness," he says.

The continued focus on exotic species is expected to be one way that companies will try to differentiate themselves, but that isn't always easy, given the complexity of sourcing products from around the globe.

"The challenge is to make sure that your products offer enough volume and return on investment to support the effort it takes to bring them to market," Shaw's Knowles says.

Once the right products are picked, companies must make sure they have a reliable source—not an easy task. Supplies are affected by everything from the rainy season to new environmental regulations to changing political landscapes. The wood flooring industry has evolved into one in which the majority of volume is sold as part of a company's program, meaning that reliable supplies of exotic materials are crucial, Himes explains. "You need to supply that exact wood in that style and that color for months and months and years on end, and that's a bit of a change, especially in the world of exotics," he says.

While the emphasis on exotic species is expected to continue, domestic manufacturers are also looking for ways to give the traditional standbys new life. "Hopefully we'll find ways to make domestic species appear more exotic or more appealing through stain or other treatments," Mullican's Poland says.

Dufresne agrees. "There are ways to compete against South American products. A lot of people like the look of them, but they don't necessarily like to deal with South America," he says. Dufresne looks to an increased focus on research and development to offer innovations in engineered products, as well.

New, innovative products should only increase wood flooring's desirability, which shows no sign of waning. In fact, with the plethora of colors, species, textures and sizes, its appeal to consumers, builders and designers seems limitless. In this new global world, wood flooring manufacturers aggressively focused on innovation, fashion and technology—no matter which continent they're on—will be the ones that come out on top.

Contractor Concerns

As part of its annual survey, Hardwood Floors asked hardwood flooring contractors their thoughts on the following three questions regarding the hardwood flooring industry. Here is a representative sample of their answers:

What are the most important issues affecting your business specifically?

• Lack of a dust containment system; we have not stepped into the 21 s t century.

• Contractors without insurance or without valid licenses taking business through lowball bidding.

• 80 percent of my customers were auto-industry workers. With the trickle-down effect of layoffs, buyouts and uncertainty in the regional economy, business slowed. P.S. I miss the mid-'90s.

• Taking the time and the expense to do the job correctly and still compete against other businesses or contractors who take shortcuts and cut expenses to give a cheaper bottom-line price.

• Explaining the difference between a quality sanding job and a poor sanding job, and between quality finish and cheap finish, when trying to sell a job to a customer.

• People are asking and demanding more "green" products. To be successful in the future, we need to accommodate them.

• Prefinished is taking a big bite out of the pie; the coming generation doesn't have the same feeling about "real wood" as the Boomers.

• Business expenses: gas prices, wood prices, finish and labor. With customers' spending slowing down, there is more competition for these jobs.

• Too many people in the flooring business in this area. Ten years ago there were six to 10 contractors. Now we have from 40 to 50 in the same area with less work.

• Finding builders willing to follow the NWFA's "Installation Guidelines" is becoming more difficult.

• In southeast Michigan, new construction has plummeted at least 60 percent from one to two years ago. Remodeling has increased as a result.

What are the most important issues affecting the industry as a whole?

• Too many folks out there aren't trained well enough. In my first month of business, I had to fix errors for three different companies.

• Quality. As standards are lowered to provide more profits, quality is given up. As quality is sacrificed, the industry will certainly lose market share.

• Distributors are doing more to improve the quality of the products they sell, moisture contents, training and open house demos.

• Quality control from the manufacturer. I am finding a lot more different-sized widths in the same box.

• Getting close to zero dust on the job site.

• The industry is switching from being contractor-driven to being part of the floor covering business. This has taken place with the advent of prefinished flooring and big marketing programs. Contractors cannot compete with the advertising that is done by carpet stores and big-box stores.

• The health of the national economy.

• As the demand for wood flooring continues, education, proper training and customer information must be key.

• Very cheap pricing from illegal labor and illegal businesses, with prices for labor that go back 15 to 20 years.

• Telling customers how to take care of their floors.

• Soon the dustless equipment will take over a lot of residential floors and other job sites.

Please characterize the outlook in the area you serve.

• Big money is finally coming to the Midwest, and people are finally doing more than just red oak. (Nebraska)

• The housing market will slow … This may help eliminate some of the nonprofessionals competing in this market. It could be just what is needed. (South Carolina)

• Ten years ago it was 700- to 800-square-foot jobs. Now it's whole houses or all main levels of houses with an average square footage of 1,200 to 1,600 feet per job. (Colorado)

• It is looking bright. More people are selecting wood for their homes. (Pennsylvania)

• There is a major amount of new construction happening with a lot of wood going in—hopefully leading to a lot of refinishing for years to come. (North Carolina)

• It has slowed in new construction and should remain rosy in remodeling. (Oregon) • The building has slowed, but it seems remodeling has picked up. (Pennsylvania)

• As long as home sales remain strong, our market should continue to grow. (Georgia)

• I asked the question 10 years ago when laminates came on strong: Why put something in that looks like hardwood when you can install hardwood? I see people going back to the real basics—hardwood. (Nevada)

China: A Look Inside

By Ricardo Pairazaman

China has emerged as one of the most important international markets for manufactured wood products, and the Chinese market for wood flooring is particularly strong, holding signific ant potential for all the machinery and finishing products associated with the installation of wood flooring.

The Chinese construction sector continues to expand, driven primarily by rapid urban expansion, rural housing developments and major upcoming international events, including the 2008 Olympics in Beijing and the 2010 World Expo. These factors have triggered tremendous demand for effective sports flooring systems, but the market for residential and commercial wood flooring is also booming. Commercial and residential housing starts for 2007 are estimated to increase by 5 percent to 19,600,000 units (GAIN Report CH6052). According to the Americ an Hardwood Export Council (AHEC), based on reports from the Chinese Ministry of Construction, the Chinese flooring sector produces more than 200 million square meters (2.1 billion square feet), with over $36 billion in annual sales. Additionally, as reported at the China Wood International (CWI) show in Shanghai in November 2006, over 60 percent of the wood flooring produced in China is destined for the Chinese market. Indeed, the Chinese Ministry of Construction estimates that, by 2008, new flooring demand in China will reach 2.5 billion square meters (26.9 billion square feet).

It is important to note that, while China offers significant opportunities to the suppliers to international wood flooring markets, the market faces a number of challenges. I recently conducted two seminars in China for AHEC, which has been working there for 10 years to develop a market for American hardwood. Based on my observations during the trip, contractors and developers are primarily concerned about proper concrete subfloor preparation for wood flooring systems, techniques and instruments for controlling moisture content, and wood properties.

Common Chinese building practices currently limit growth opportunities for solid wood flooring. According to sources from the field, 95 percent of construction in China is concrete-based. Basic tools, such as moisture meters, vapor barriers and certain glues, are not widely available in the Chinese market. In addition, for the most part, building standards for high-rise construction only leave 1/2 to 1 inch of clearance between the concrete subfloor and the doors. This allows sufficient room for installation of only tiles, laminate flooring, c arpet and other stable, nonhygroscopic material. Some construction companies have adapted screed installation systems to their needs by using thinner boards, but this practice may limit the holding power of fasteners, tending to precipitate failures. At this time, therefore, the Chinese residential market is best suited for engineered wood flooring systems. Given that most engineered wood flooring in China is prefinished, the Chinese market should also trigger signific ant opportunities for recoating systems. Opportunities for solid wood flooring systems lie primarily in the commercial and sports flooring sector, but experts there anticipate that the residential market will develop to accommodate solid wood flooring in the future.

Another major issue is the lack of grading standards for Chinese manufactured flooring. At a CWI roundtable discussion, participants debated whether, due to the failures of Chinese flooring in export markets, Chinese manufacturers should develop a grading system that certifies the quality of its products.

The Chinese market for wood flooring and associated products is poised to expand dramatically. As the Chinese market grows, the North Americ an wood flooring industry, with its extensive experience and knowledge, is well-positioned to meet Chinese demands.

Distributor Discussion

In its annual survey, Hardwood Floors asked hardwood flooring distributors for their input on the following three questions regarding the wood flooring industry. Here are some representative responses:

What are the most important issues affecting your business specifically?

• Continued and growing acceptance of high-quality imported engineered flooring by consumers.

• Profit margins have been pushed down because of the big-box stores, the Internet, manufacturers selling direct and the proliferation of overseas imports.

• Fuel costs for inbound freight and outbound shipping.

• Anyone can get wood flooring from anywhere, at any place, at any time.

• Mills not respecting the chain of mill to distributors to retailers to the public.

• Slow housing starts.

• Educating customers and their clients … people don't understand what the real issues are with wood moisture, expansion, etc.

• Getting good help.

• Stagnation of the housing market.

• Too much product in the marketplace.

What are the most important issues affecting the industry as a whole?

• Imports from China and the Far East. Pricing is very low.

• The impact of illegals working as flooring specialists without proper business licenses, I RS tax certificates or workers compensation documents. Their pricing is so low that we are losing very qualified, expert flooring specialists because they cannot compete.

• Pricing is shrinking the profit margins of the industry.

• Distinguishing the quality products produced by major manufacturers from lower-quality imports.

• The customer is being misled on the quality of products.

• Overproducing ourselves in flooring.

Please characterize the outlook in the area you serve.

• When housing recovers, so will we. (Florida)

• Somewhat less bright than in 2006, but still a good year. (South Carolina)

• Very tough; building is dead. (Wisconsin)

• Building seems strong for higher-end homes, so wood sales should remain strong. (Utah)

• The outlook seems great in this area because of the growth in new homes. (North Carolina)

• Our target is to grow 12 percent in 2007. (Vermont)

• A moderate first quarter with normal growth being reached by the fourth quarter. (Nevada)

• The overall outlook is good and improving, but changing. (Alabama)

• Continued growth, especially in exotics. (Florida)

• The outlook for New York City is good. (New York)

• Excellent. (Montana)

• Up 5 percent over 2006. (Tennessee)

Adding it Up

Spending Power

Of the contractors surveyed (more than one answer possible) ...

88% buy from specialty wood flooring distributors

27% buy from general floor covering distributors

23% buy from a big-box store

22% buy direct from manufacturers

At a big-box store, contractors say they are most likely to buy (in order of likelihood):

- adhesives

- installation tools

- finish

- wood flooring

- sanding equipment

- abrasives

At a big-box store, distributors think their contractor customers are most likely to buy:

- wood flooring

- installation tools

- finish adhesive s (tied)

- abrasives sanding equipment (tied)

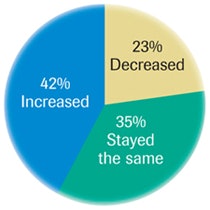

Contractors' Business in 2006 ...

In 2005...

• 53% of contractors indicated that business increased

• 33% stayed the same

• 14% decreased

Wood or Plastic?

Of the distributors surveyed ...

35% sell a laminate product

65% do not

61% expect laminate to grow

39% do not

Chain Gang

Of the distributors surveyed ...

41% said their business has been affected by big-box stores such as Home Depot and Lowe's

59% said they have not been affected by big-box stores

22% sell some product online

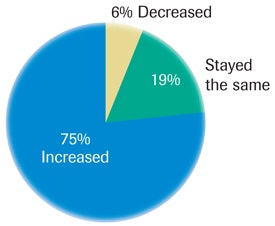

Distributors' Business in 2006 ...

In 2005 ...

• 69% of distributors indicated that business increased

• 14% decreased

• 17% stayed the same

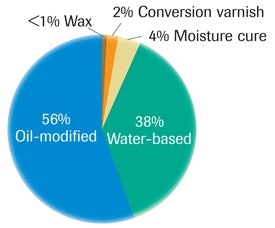

Finish Used by Contractors

In 2005, contractors said ...

• 56% oil-modified

• 31% water-based

• 11% conversion varnish

• 2% moisture cure

• <1% wax

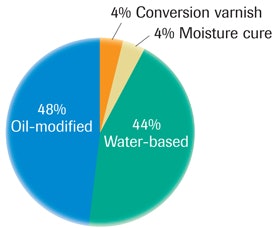

Finish Sold by Distributors

In 2005, distributors said ...

• 46% water-based

• 44% oil-modified

• 6% conversion varnish

• 2% moisture cure

• 1% wax

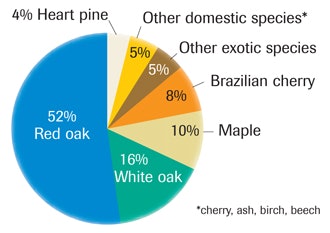

Species Installed by Contractors

The contractor numbers in 2005 were ....

• 50% red oak

• 22% white oak

• 8% Brazilian cherry

• 7% maple

• 7% other exotic species

• 5% other domestics (cherry, ash, birch, beech)

• 2% Heart pine

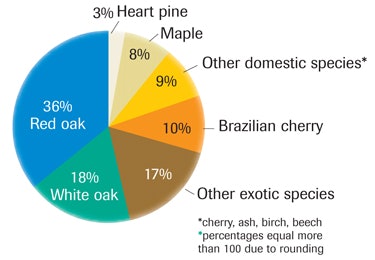

Species Sold by Distributors*

The distributor numbers in 2005 were ....

• 36% red oak

• 17% white oak

• 17% other exotic species

• 11% Brazilian cherry

• 10% maple

• 8% other domestics (cherry, ash, birch, beech)

• 1% Heart pine

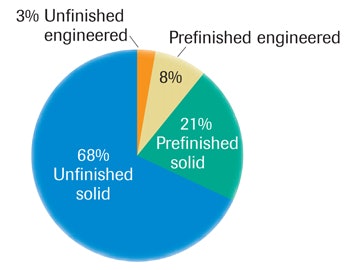

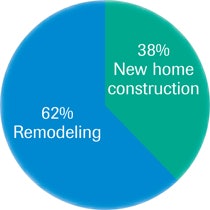

Contractors Are Installing ...

Contractor numbers in 2005 were ...

• 62% unfinished solid

• 20% prefinished solid

• 17% prefinished engineered

• 1% unfinished engineered

Distributors Are Selling ...

Distributor numbers in 2005 were ...

• 49% unfinished solid

• 33% prefinished solid

• 17% prefinished engineered

• 1% unfinished engineered

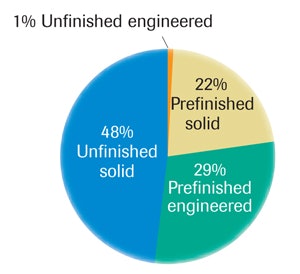

How Contractors Spend Their Time

What They Do ...

In 2005, contractors divided their business, on average ...

• 48% sanding/finishing/refinishing

• 52% wood flooring installation

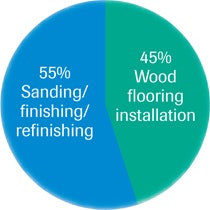

Brand New vs. Renew

In 2005, contractors divided their business, on average ...

• 62% remodeling

• 38% new home construction

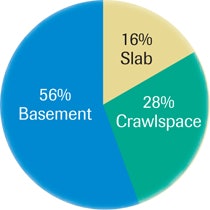

Subfloors Are ...

In 2005, contractors installed over ...

• 48% basement

• 30% crawlspace

• 22% slab