The Homeowner's Issue

Following some water damage, the homeowner's insurance covered a wood floor restoration. The restoration contractor's scope of work was to dry an existing wood floor back to original moisture content, sand and stain to match the existing wood floor in the entryway, kitchen and a closet. Afterward, the homeowner found puddles, some buffing swirls and circular ridges the size of quarters in the entryway. The flooring subcontractor returned four times to repair issues the homeowner reported. The flooring subcontractor said the repairs were sufficient. The homeowner disagreed.

Roy: The Inspector's Observations

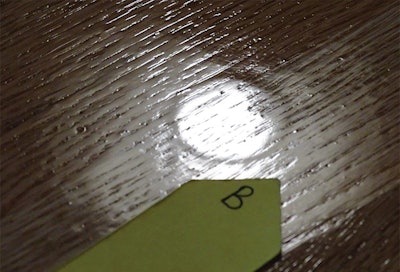

The wood floor was solid red oak with oil-modified polyurethane finish. The wood flooring moisture content at time of inspection was between an industry-standard 7.0 to 7.8%. The inspection found the floor finish was a high gloss with deficiencies such as dry spots (applicator streaks/misses), drips, puddles and brush drag marks that could clearly be seen from a standing position. There were also light buffer swirls within the finish in random locations. One could clearly see the circular drip was screened over but failed to be removed. There was also finish pooling from the finish application. The floor will need to be resanded to correct the multiple finishing concerns.

Blake: The Attorney's Analysis

It is not uncommon to find workmanship issues on insurance projects, because often all parties involved seek the least expensive option for performing the work. People often ask whether the insurance company has any responsibility in these situations. However, legally there are two different contracts in place: the insurance policy between the homeowner and the insurance company, and the construction agreement between the homeowner and the contractor. So even if the insurer referred the contractor, the insurer has no liability for defective work. In the case above, the flooring contractor is clearly responsible to refinish the floor. However, if the homeowner incurs other damages (such as temporary lodging) while the floor is refinished again, the ability to recover those will depend on the agreement with the flooring contractor. Contracts for flood restoration jobs are usually short and likely do not address consequential damages, and the fine print may, in fact, contain a disclaimer of consequential damages. Most likely the homeowner will have no claim to recover other out-of-pocket costs and may only be able to force the contractor to refinish the floor properly.

This drip was one of many finish flaws on this insurance job.

This drip was one of many finish flaws on this insurance job.