It's seven years and counting in the wood flooring industry's current growth cycle. That matches the growth spurt the industry experienced from 1983 to 1989 — one that was briefly interrupted by the housing recession of 1990-91. This time around, favorable interest rates and a strong economy seem to promise a housing market that will remain — at worst — stable for the foreseeable future. That's good news for an industry now estimated at more than $1 billion in manufacturers' wood flooring sales.

The National Association of Home Builders, for example, predicts that housing starts will total about 1.47 million in 1999 — down slightly from nearly 1.6 million in 1998, but still robust. Projections for the year 2000 are for a very healthy 1.5 million starts. NAHB also predicts that mortgage interest rates will remain low, and perhaps even drop slightly in 1999 and 2000. Remodeling expenditures should increase slightly over the next two years, according to NAHB.

There are other reasons to believe the wood flooring market will remain strong. Lumber prices have moderated over the past year, and wood flooring prices have followed suit. The lower lumber prices also help reduce the upward pressure on housing costs. A five-cents-per-foot change in lumber prices can mean a $1,200 difference in the cost of a home, according to NAHB research.

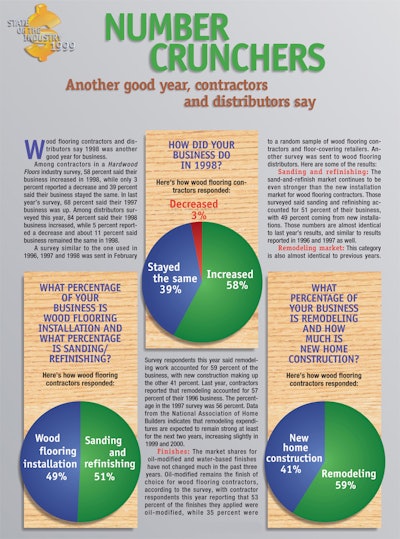

(For more data affecting the wood-flooring industry, see "Number Crunchers," p. 86.)

Manufacturers, distributors, dealers and contractors alike seem to believe the growth trend will continue. Some are even more upbeat than they were a year ago, when the word "cautious" nearly always preceded the word "optimism" in any industry conversation.

"I was pretty positive a year ago, and I still am," says Hugh Pugsley, vice president of sales and marketing at PermaGrain Products in Newtown Square, Pa. "Historically, we've done well anytime there's a strong housing market, and it looks like we're going to continue to see a good, stable economy. Also, the price of raw materials is going down, and that's important so we can remain competitive with other floor coverings."

Mike Kearins, former vice president of sales and marketing at Triangle Pacific and now president of his own Dallas-based consulting firm, Pinnacle Concepts, expects "continued strong growth throughout the wood flooring industry. I don't see where any segment is going to slow down at all. I think there's going to be continued price stability and pricing pressure on the factory-finished flooring distribution channels."

"I would expect annual growth of 8 to 12 percent over the next several years," says Tommy Maxwell of Maxwell Hardwood Flooring in Monticello, Ark. "Currently, we have overproduction in the industry, which will take some time for the marketplace to absorb, but overall the hardwood marketplace looks strong."

Stan Elberg, executive vice president of the National Oak Flooring Manufacturers Association, says some NOFMA members are reporting lower prices and increased inventories of wood flooring, but that demand remains strong.

"The inventory we have is simply a result of the fact that production capacity has increased, so we have more wood flooring in the marketplace," says Elberg. "If you look at our February shipment numbers, they're up 16 percent over February 1998, and for the first two months of this year we're up 8 percent over last year. So, demand is still increasing. I think we're going to continue to see fairly steady growth."

"In the next five years, we project that wood flooring will gain more than 10 percent of the total floor-covering market," says Ulf Mattsson, president and CEO of Harris-Tarkett in Johnson City, Tenn.

"We expect continued significant growth well into the foreseeable future," says Chris Thompson, vice president of sales and marketing for Triangle Pacific's flooring division. "The market is there."

"I feel pretty strongly that the industry will continue to do well for at least the next five or six years," says Neil Poland, president of Mullican Floors in Maryville, Tenn. "With the demographics of the Baby Boom generation, unless there's a major drop in consumer confidence, we should be pretty well insulated from recession for some time to come."

"The wood flooring industry will grow in 1999, as long as interest rates are low," says Nicholas Stern of Satin Finish Hardwood Flooring in North York, Ontario. "The economy is chugging along nicely and housing starts will continue to ring in increased sales of hardwood flooring. A substantial increase in interest rates would definitely have a negative impact on hardwood flooring production and sales."

"My expectations for the wood flooring industry are that — for at least the next two years — wood flooring will continue its steady climb and will more aggressively penetrate regions where it has not been as commonly used," says Jonny McSwain of McSwain Floors in Cincinnati. "Wood flooring is very healthy in our area, which is typically a conservative, strong commodity market that doesn't seem to be affected a great deal by trends or competing floor surfaces. I expect to see continued slow growth, which could only be hampered by a lack of qualified installers."

"We're looking at 25 percent growth for the next two years," says Tom Burns, president of Gulfstream Flooring Distributors in Tampa, Fla. "That's as far out as we can project. A lot of that is due to new housing, which continues to be strong and is not projected to slow down in this area."

"I see continued growth for the next two years, in the range of 5 to 10 percent in specialty products," says Robert Kulhawy, president of HFI Flooring in Calgary. "Canada will continue to have regional economies strengthen in some areas, and weaken in others."

Terry O'Neill of TRC Timber Realization Company in Calgary expects continued growth for wood flooring in Western Canada for the foreseeable future.

"We are seeing an increase in demand by consumers for durable flooring," says O'Neill. "I feel hardwood will be competing with ceramics and laminates for portions of the increased demand. However, even though demand is increasing, we are seeing increased competition at all levels (mill through contractor), and lower margins. Wood flooring is becoming a commodity and it is difficult to offer competitive prices while still delivering the service to which retailers and contractors are accustomed."

"The wood flooring industry should continue to grow at a rate faster than flooring as a whole," says Jeff Hamar of Galleher Hardwood in Santa Fe Springs, Calif., "although the growth rate will slow."

"I honestly see a very strong demand for hardwood flooring for at least five years or more," says David Williams of Horizon Forest Products in Raleigh, N.C. "Every ad or article I see now continues to show hardwood flooring in a very positive light. Homes today are looked at as investments, and hardwood flooring is the best floor-covering investment there is."

Williams expects that growth will be particularly strong in the Southeast region.

"The economy is good in this area and businesses continue to expand. Growth will remain strong well into the next millennium."

"I think the outlook for the industry is somewhat softer than it has been for the last three years, but still strong," says David Bennett of Bennett Supply Co. in Cheswick, Pa. "I would expect to see greater growth in commercial specifications for the retail and hospitality industries."

"In the next year, I think we can expect to see a leveling out for the flooring industry as a whole," says Jim Garth of Decorative Flooring in Marietta, Ga. "However, wood flooring should increase again in overall market share, due to consumer awareness of new product lines through media exposure."

"I would have to think it's going to remain strong for at least another five years," says Reid Easton of Woods of the World in Waterford, Mich. "With the combination of extensive land development and people's natural affinity for wood, we should be all right."

As evidence of the strength of the wood-flooring market in the Pacific Northwest, John Pankratz Jr. of Kelly Goodwin Co. in Tukwila, Wash., points to the increasingly competitive distribution business in Washington and Oregon. "Business must be good; otherwise, why are there so many competitors in this market?"

Competition will also be keen among manufacturers, according to Rick Brown, president of FrenchBrown Wood Floors in Dallas. Brown, who expects to see "moderate growth" in 1999, believes there will be "many new players in the field, particularly in prefinished engineered products. The pie may be bigger, but there will be more slices." Competition from other floor coverings will also be strong, Brown says, "but as long as we are able to provide a quality product at a justifiable price, our industry should remain stable and profitable."

Brown sees isolated areas of concern. "For example," he says, "the current price of American cherry is so high because of demand from the furniture and veneer industry." Mostly, however, Brown believes the "soft state" of some foreign economies bodes well for keeping prices down in the North American wood-flooring industry. "Less wood leaving the U.S. translates into lower prices on many domestic species, particularly oak," says Brown.

John Stern, president of Kentucky Wood Floors in Louisville, Ky., expects to see "continued growth, especially in proprietary, high-profit specialty floors that feature design and species uniqueness. I would also expect to see strong partnerships between manufacturers, distributors and dealers, with manufacturers expanding services, distributors adding value and dealers offering competitive product lines and hassle-free installation."

Tryggvi Magnusson, president of Award Hardwood Floors in Wausau, Wis., believes the wood flooring market will double in the next six to seven years, with the engineered wood flooring segment growing at 25 to 30 percent per year.

"The demand for wood floors is steadily increasing and will continue to increase as long as manufacturers keep two key factors in mind," says Magnusson. "We need to make buying wood floors easy, and we need to meet all the customers' demands, including easy-care products."

"We expect wood flooring to continue its momentum and growth far into the new century," says Jim Schweiger of The Burruss Company. "The variety of products in the wood sector, and the many natural attributes of real wood exceed the alternate floor coverings of today.

"Wood supply is very strong, and wood flooring installation expertise and ease are gaining each year. New products, which are increasingly DIY-oriented, along with increasing quality of traditional solid flooring standards, are spurring the growth across many sales channels," Schweiger adds.

"I'm more optimistic about the industry than I was a year ago," says Stern of Satin Finish, "because every day the hardwood flooring manufacturers are coming closer to realization of the fact that we could produce and sell tons more product if we informed the consumer better about the natural and health benefits of hardwood flooring, the lifelong durability and ease of maintenance."

"The future for hardwood flooring has really never looked better," says Rick Brian of R.B. Brian & Associates, a consulting firm based in Loveland, Ohio. "Just look at the tremendous capital investment companies already in the industry are making, and the influx of major companies into the industry. Those companies wouldn't be doing that if they didn't see a very bright future for wood flooring."

DRIVING THE MARKET

There are, of course, multiple factors affecting the wood-flooring industry — many of which are outside the industry's ability to influence change. As Brown notes, demand for wood from the furniture and cabinetry industries can affect both the supply and the cost of some grades and species of wood. Mortgage interest rates, lumber costs and even foreign economies all play a part in increasing or decreasing the demand for and the cost of wood flooring. So, a key question becomes, What factors can people in the industry control or influence, and what should they do to maximize the industry's future?

"One of the factors we can control is marketing wood flooring as a very attractive design element, enhanced by durability," says McSwain.

The industry should also address quality control at both the manufacturing and installation levels, says McSwain.

"The greatest factor we can and should influence is that of consumers' and retailers' impressions about woodflooring products," says Magnusson. "Many still see wood flooring as complicated to sell, buy, install and maintain. As we know, this is not true. As manufacturers, we need to arm retailers with the knowledge and tools they need present wood flooring as a viable option for their customers."

One of the primary factors driving growth is "consumers' desire for natural products — feeling good about natural products — and hardwood flooring answers that desire," says Thompson of Triangle Pacific. "In addition, the new finishing technology on prefinished flooring also helps, answering consumers' questions about the longevity of finishes and allowing hardwood flooring to compete with the faux surfaces."

Garth of Decorative Flooring believes the continued and expected growth in wood flooring sales is a result of multiple factors.

"I think it starts with manufacturers being able to meet market demands and continually improve products," Garth says, "but there's also been increased media exposure of wood flooring products through the Internet, as well as construction-industry and home-related publications. Then there are the NWFA and NOFMA training schools that are providing the industry with more capable installers."

"The basic concept of listening to the needs of the market is the main vehicle for influencing the industry," says Mark Brorby, president and CEO of BonaKemi USA. "For manufacturers, successful products will always result from listening to what your customers want — what they need to be successful — and then focusing your research and development accordingly. Providing quality products and services at every level of the industry — the manufacturer, distributor and contractor — will result in maintaining high perceived value of hardwood flooring."

The strong economy will be a major force driving continued growth in wood flooring sales, says Mattsson of HarrisTarkett, "but the consumer's growing support of natural products will continue to impact the future sales of hardwood flooring. While we cannot directly influence overall economic conditions, we can continue to position hardwood flooring within the hard-surface flooring segment as the product of choice for quality and value, and we can work to keep our prices competitive."

"The industry has very little influence on factors such as the economy, interest rates and home building," says Williams of Horizon Forest Products, "but we can continue to gain market share, which in turn will give us a stronger position."

THE WINDS OF CHANGE

Growth will also come as a result of a continuing evolution in the products the industry sells, most industry participants agree. Prefinished and engineered wood flooring usually top the list of fastest-growing products, but there are other trends emerging.

In western Canada, says O'Neill of TRC, "prefinished flooring continues to grow in acceptance over site-finished. This likely will continue as prefinished manufacturers are increasing wear warranties. Site-finished flooring is still the preferred choice in areas with good availability of skilled sanders, but prefinished is catching up."

Maxwell expects traditional 3/4 -inch solid wood flooring to remain strong, but that thinner solid products ( 5/16 -, 3/8 and 1/2 -inch flooring) will grow as manufacturers address environmental issues — "making more products out of less wood," says Maxwell, who expects engineered wood flooring to do well for the same reason. Satin Finish's Stern agrees that thinner solid flooring products are likely to increase in use.

"If these products are specified, promoted and sold properly and honestly, they could represent a whole new aspect of hardwood flooring, translating into increased sales," says Stern. "I expect this to be the growth area in the next five years."

Kearins of Pinnacle Concepts also sees growth in thinner profiles of wood flooring, both on the solid and engineered sides, and he also expects that engineered flooring manufacturers will begin to introduce "non-traditional materials in the core. These will be denser core materials — such as HDF (high-density fiber) boards — that will allow the use of thinner, higher-quality veneers on top."

"All sectors of wood flooring should continue to grow, and the big growth is likely to be in factory-finished products that lean toward easier installations," says Schweiger of The Burruss Company. "Obviously that hints closer to engineered wood segments, but I think we will also see some new ideas and developments in the solid floor segments."

"We project that the prefinished segment will continue to grow, and more specifically the prefinished engineered segment," says Mattsson of Harris-Tarkett.

Thompson of Triangle Pacific agrees that factory-finished wood flooring is growing — "and especially making inroads among builders" — but that both solid and engineered, unfinished and prefinished, "are growing significantly, not one at the expense of the other. We would expect to see continued overall growth in all product segments."

Borders, inlays and alternate species: With the growth in prefinished flooring has come an increased interest in ways to customize that flooring with borders, medallions and other decorative touches.

"Most large prefinished flooring manufacturers have implemented plans to offer designs in their flooring, and the inlay manufacturers have positioned themselves to handle more requests for prefinished products," says Jim Garth, president of Decorative Flooring in Marietta, Ga. "I think we'll also see an increased interest in products with simplified installation techniques." "I'm more optimistic about the industry because of the potential for market-share growth and the creative growth of borders and inlays," says Williams. "Also, there is growth potential in different species of wood, both domestic and imported."

"We're seeing a lot more interest in different species," says Pankratz. "Gone are the days when you could survive on red and white oak. We still sell a lot of that, but we're seeing more demand for maple, cherry, ash, hickory and Brazilian cherry. A lot of that is driven by the cabinetry market."

Wood flooring's positioning as a highquality flooring choice offers some cushion against price competition with other flooring choices, but most observers believe manufacturers, distributors, retailers and contractors will all have to find ways to make sure wood flooring's cost is not out of line with its value. That will be a focus for most manufacturers in the coming years.

"Manufacturers will continue to achieve efficiencies that will allow us to keep our products competitively priced when compared to other hard-surface flooring options," says Mattsson.

Finishes: "The continued growth and prosperity of the wood flooring industry has obviously been a benefit for manufacturers of stains and finishes also," says John Mayers, national sales manager for Dura Seal/Fabulon. "The sand-and-finish segment continues to grow with the market. The trend in stains has been just that — a resurgence in stain colors demanded by the floor owner. The colors desired have been light to natural, with red tones continuing their strong popularity. Darker colors are beginning to make a comeback, but only time will tell if this trend will continue."

One of the more notable trends over the last decade has been the growth in water-based finishes, although oil-modified urethane has remained the leader in the finish segment. Some industry observers believed water-based finishes and lower-VOC finishes in general would get a boost when the U.S. Environmental Protection Agency approved national VOC regulations in architectural coatings, expected to be set at 450 grams of volatile organic compounds per liter. That did, in fact, become the standard, but when the regulations were published last fall, they included exceedance fees, tonnage exemptions, grandfather clauses and quart exemptions that allow manufacturers to continue to sell traditional finishes that typically average 550 grams or more per liter.

"I was disappointed with the outcome of the EPA's decision on a national standard for VOC emissions," says Mark Brorby of BonaKemi. "However, regardless of what is legislated, manufacturers should not lose sight of some of the main issues, including concern for the personal health of the contractor, and the protection of the environment. Products that are safe, environmentally friendly and high-performance, and that offer a high value in relationship to cost, will do well in the near future."

"I was prepared to say that the VOC laws would have a negative effect on the popularity of traditional oil-based poly. Fortunately for the industry, I was wrong," says Mayers. "The industry has spoken and the EPA listened. Traditional poly may go through some changes, but will still be available in the market. Contractors who believe in the value of these finishes will be pleased, to say the least."

"Finish manufacturers can contribute to the success of the wood flooring industry by continuing to make available better, easier ways to maintain and preserve customers' hardwood flooring investment," says Kathy Schott of Basic Coatings. "It's surprising to find that many commercial environments such as clothing stores and restaurants are still afraid of wood floor maintenance. Education is a big part of overcoming that, and that responsibility will continue to be shared by the manufacturers and distributors of all wood-flooring-related products."

Structural changes: Beyond product changes and pricing issues, many see changes occurring in the way the industry is structured and the way it competes in the market. As always, environmental issues occupy a central place in the industry's concern.

"I think most of us are interested in the environment," says Pugsley of PermaGrain. "We recognize that good business means good stewardship of the environment. So, I think you'll see more certified documentation of where the wood comes from, because that's what our customers are asking for."

Web sites, E-mail and electronic commerce will play a much larger role in the industry.

"We're going to see much wider use of computers, especially the Internet, for communication," says Stern of Kentucky Wood. "Eventually, everyone will have a laptop."

The need for more product options will also encourage manufacturers to offer retailers and contractors borders, inlays and other accessory items at price levels their customers will find attractive.

"You'll see more small and medium-sized manufacturers providing mass customization of products," says Stern.

Many expect to see a continuation of the consolidation trend of recent years, with acquisitions and mergers reducing the number of players. Last year's acquisition of Triangle Pacific by Armstrong World Industries, and Harris-Tarkett's acquisition of Stuart Flooring are only two of the more notable recent instances.

"Consolidation within the flooring industry will continue," says Mattsson of Harris-Tarkett, "as manufacturers, distributors and retailers continue to assess their product lines, distribution channels and market-support needs."

"I expect to see more consolidation, from the manufacturer to the distributor to even some contractors," says Williams of Horizon Forest Products, "but I also expect to see more expansion of different types of hardwood flooring products as companies try to find a niche."

Others agree that at the same time consolidation is reducing the number of players, the prospects for future growth will continue to attract more players into the industry.

"I see our market becoming even more competitive," says Pankratz of Kelly-Goodwin. "The one saving grace is that there a lot of different woodflooring options now, so there's room for more players in the market. I would expect that it will shake out somewhat. You just have to do what you can to hold your own."

"I sense that the current capacity of the industry could be a limiting factor," says Dave Hickman, president of Universal Flooring in Dallas, "but it could also present a window of opportunity for other companies to enter the market."

"One of the biggest things that concerns me is that with the collapse of the Asian markets, we're seeing a lot more overseas wood-flooring manufacturers entering the North American market," says Burns of Gulfstream Distributors. "But if they come into the market and are not able to get distribution, because the distribution channels are tied up, they may have to go direct to retailers. Most flooring manufacturers right now are very committed to their distribution network, but if they start to see their market share eroded, that could change over the next 10 years or so."

Burns says distributors trying to sell to the retail floor-covering market are also somewhat at the mercy of whether or not their suppliers are aggressively marketing their products to the buying groups, like Carpet Max, Carpet One and Shaw.

"The buying co-ops are playing a bigger and bigger role if you're trying to sell prefinished wood flooring to retailers," says Burns. "If you're going to have any success in that part of the market, you have to be a part of that, but it has to be done at the manufacturer level."

For wood-flooring distributors and retailers alike, the "big box" home-improvement retailers like Home Depot, Builder's Square and Loew's are apparently an increasingly competitive presence in the market.

Whatever other challenges the industry faces, however, "the key to our industry remains at the contractor level," says Williams. "Without skilled people to install and finish the products, the industry can't continue to grow. As an industry, we have to put our money into training the next generation of contractors so the industry will prosper into the next millennium."