Despite rising interest rates and a slight leveling off in housing starts this year, few people in the wood flooring industry believe it will be enough to seriously dampen the growth that has characterized the overall economy and fueled dynamic growth in the industry for most of the past decade. Not even an expected increase in lumber costs this year seems likely to spoil the party. In fact, it looks like nothing short of a major downturn in the stock market can stop the overall economy's upward momentum, both in the United States and Canada.

Interviews with a wide assortment of manufacturers, distributors, contractors and retailers found a remarkable degree of consensus on a variety of issues affecting the woodflooring industry. Here's a summary of their thoughts on those issues:

The Economy

Housing starts are expected to decline slightly from last year's totals, but will continue to be strong at about 1.3 million units. Rising interest rates might slow housing growth some, but as long as the overall economy is healthy, housing construction should remain strong. And the only thing likely to derail the economy is a dramatic drop in the stock market — probably something as severe as a 40 percent decline.

The retail construction segment is expected to continue to grow at a rapid pace. Retailers are using wood flooring more often, and the product is expected to grow in acceptance as retail operators become more aware of the durability of wood flooring finishes, as well as the increasing design options available.

While remodeling has slowed somewhat, it's still robust enough to create strong demand for hardwood flooring.

Flooring Segments

Hard-surface flooring is expected to grow faster than carpet, with wood and ceramic leading the growth. Vinyl and carpet will remain flat, and laminate flooring will grow at a slower rate than in the past. Laminate flooring is also expected to see continued falling prices and shrinking profit margins, as competition increases in the segment. In some areas, retail prices for laminate flooring have decreased by 60 to 70 percent. Some distributors who sell laminate flooring, as well as wood, complain that laminate manufacturers oversold the benefits of the product, leading to consumer disillusionment with laminates.

At the same time, many believe that the aggressive advertising of laminate flooring has created more of an awareness and demand for real wood products. As a result, some say, many owners purchased laminates with unrealistic performance expectations and now are turning to wood flooring products.

Within the wood flooring industry, unfinished solid flooring remains the foundation of the industry, and remains strong in most Northern urban markets, where there is a greater demand for custom finishing in large luxury homes, and where there is normally a sizable pool of sand-and finish talent.

Prefinished is gaining ground as a percentage of sales, and some predict it will exceed sales of unfinished for 2000. Prefinished engineered is especially strong in the South and in Southern California, where slab construction dominates. Some see prefinished engineered products as the wood flooring industry's answer to laminates, with finish technology and warranties echoing those of the laminate segment.

High-rise luxury condos and apartments are springing up with more frequency in many urban markets, and floating floors are finding more wide acceptance in those applications.

Specialty parquet flooring, as well as borders and medallions, are enjoying a resurgence, but the linear look of strip and plank is still dominant, and mass-produced fingerblock parquet is all but dead.

Product Changes

Laminate manufacturers and European hardwood flooring manufacturers have pushed the technology envelope, and some North American wood flooring manufacturers are responding, investing in equipment that will reduce overwood and mismilling.

Increasing pressure on forest resources will also cause manufacturers to develop products that obtain better yields and produce less waste. Solid wood flooring will encounter the most change, with thinner, lower-cost products — 3/8 -, 5/16 - and 1/2 inch — becoming more popular.

With the arrival last year of a national VOC rule, most agree that water-based finishes will increase in market share, but oil-modified polyurethane remains the leading segment across the board. Conversion varnish — although less than 5 percent of the overall finish market — is still strong in the Pacific Northwest, although manufacturers of the product say they expect that water-based finishes will begin to gain popularity even in that region.

The Environment

Forest-management practices have been under intense scrutiny in recent years, leading many in the wood flooring industry to believe that the industry needs to be more assertive in defending those practices and educating the public, and others to suggest that land-use certification might be a way to reassure the public that forest lands are being harvested responsibly.

A few wood flooring companies have undergone the certification process, but many in the industry believe the public isn't interested enough in the issue to cause serious concern among wood-products manufacturers or distributors. As a result, they say, the added cost of going through the certification process isn't justified on economic grounds, and won't be unless consumers are willing to pay extra for the assurance that their wood products come from sustainably harvested forests. The consensus: Forestry issues are worth watching, but are not an immediate or serious threat to the industry.

Meanwhile, most in the industry agree, wood flooring's environmental story should focus on wood as a renewable resource, as well as a product with a positive impact on indoor air quality.

Consolidation

Consolidation at the manufacturing level appears to have abated and most feel there will be limited activity this year. The consolidation activity will center around full-line floor-covering distributors, who are aiming to become low-cost providers of product by creating purchasing power and increasing their market share.

At the same time, however, wood-flooring distributors will be able to thrive by focusing on service and delivery, rather than price.

The Internet

The explosion of e-commerce and the effect it is having on traditional channels of distribution may lead many to think that within 10 years, the hardwood flooring industry will be unrecognizable. However, most of those interviewed agree that wood flooring will not be sold in great quantities over the Internet.

Difficulties in shipping and installation make wood flooring much more complicated to sell over the Internet than most products. And even automobiles sold over the Internet still need a dealer to take delivery.

Instead, many believe, consumer marketing over the Internet will be primarily an educational tool for manufacturers, distributors, contractors and dealers. However, the Internet will probably be used increasingly in business-to-business applications for order placement, inventory control, accounts payable and accounts receivable transactions.

Personal Touch

Finally, those interviewed agree that no matter what technological or structural changes occur in the next decade, the wood flooring industry will remain one characterized by traditional, one-on-one attention. The manufacturers, distributors, contractors and retailers who succeed, they say, will be those who stay attuned to their customers' needs, and offer them not only technically superior products and services, but also the assurance that if there's a problem to be solved, there's someone they know on the other end of a phone line ready and willing to do so. Some things never change.

Research and reporting assistance for this article was provided by Ed Korczak, executive director of the National Wood Flooring Association, and Mike Hanlon, a free-lance writer and former sales representative for Sykes Flooring. Interview sources for this article included Brett Wheeler, Berger-Seidle America; Brian Roberts, Franklin International; Bruce Whisenhunt, Palo Duro Hardwoods; David Williams, Horizon Forest Products; Dominic Reda, Merle B. Smith; Doug Lux, D-Lux Hardwood Floors; Jeff Horn, Aged Woods; Jim Duke, Memphis Hardwood; John Pankratz Jr., Kelly Goodwin; John Stern, Kentucky Wood Floors; Julie Russell, Glitsa American; Ken McLeod, Mercier Hardwood Floors; Lanny Trottman, Global Market Partners; Rich Miller, Anderson Hardwood Floors; Richard Poirier, Augusta Lumber; Rick Brian., R.B. Brian & Associates; Rick Brown, French-Brown Wood Floors; Rick Knowles, Medallion Flooring; Ron Domkowski, Powernail; Spencer Perkins, Virginia Abrasives; Steve Schoonover, Blake-Stevens Wood Flooring; Tom Dean, Dean Hardwoods; and Tommy Maxwell, Maxwell Hardwood Flooring.

Much of the information for this article came from an Industry Summit convened during Surfaces 2000. Summit participants were Jeff Hamar, Galleher Hardwood; Joe Audino, Rode Bros. Floors; John Mayers, Dura Seal; John Stewart, Tembec; Neil Poland, Mullican Flooring; Robert Kulhawy, HFI Hardwood Flooring; Ron Peden, BonaKemi USA; Tim Ryan, Longust Distributing; and Ulf Mattson, Harris-Tarkett.

The Data Game

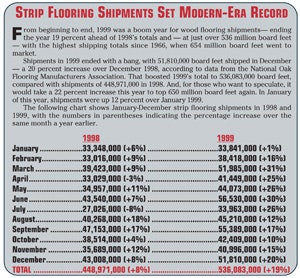

The numbers don't lie: Business is booming

A lot of people wouldn't have believed that 1999 could have been even better for business than 1998, but all the numbers suggest otherwise. Data from the National Oak Flooring Manufacturers Association tells us that strip flooring shipments in 1999 were up 19 percent over 1998 (see page 32), and companies across the board say they did better in 1999 than they did in 1998.

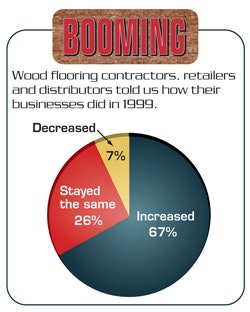

Among contractors, retailers and distributors in a Hardwood Floors industry survey, 67 percent said their business increased in 1999, while only 7 percent reported a decrease. In last year's survey, 58 percent said their 1998 business was up.

A survey similar to the one used the previous four years was sent in January of this year to a random sample of wood flooring contractors, floor-covering retailers and wood flooring distributors. Here are some of the results. (More on pages 30-33.)

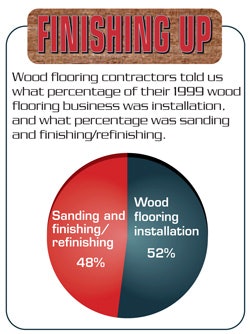

Sanding and finishing/refinishing: The NOFMA data tells us that there's a lot of wood flooring being installed, but our survey suggests that's only half the story. In each year we've done the survey, the results have been nearly identical: Installation makes upapproximately half of the business done by wood flooring contractors, the half consisting of sanding, finishing and refinishing. In this year's survey, respondents said sanding, finishing and refinishing accounted for 48 percent of their business, with 52 percent coming from new installations. Last year the numbers were 51 percent sand-and-finish, 49 percent installation. Given the margin for error inherent in any survey, there's no reason to suspect that there's been a shift of any kind. But the approximate 50-50 split has held remarkably consistent through the five years of the survey.

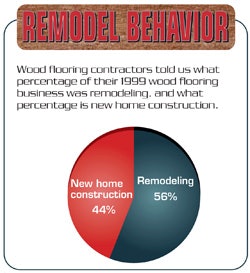

Remodeling market: There's been a similar consistency in this category throughout the years, generally suggesting that new construction and remodeling each provide about half of the work for woodflooring contractors. Survey respondents this year said remodeling work accounted for 56 percent of the business, with new construction making up the other 44 percent. Over the previous four years, contractors put the remodeling numbers at 59 percent (1999), 57 percent (1998), 56 percent (1997) and 49 percent (1996). Data from the National Association of Home Builders indicates that remodeling expenditures are expected to increase slightly this year.

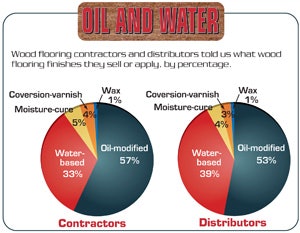

Finishes: Last year's imposition of national EPA rules governing the amount of VOCs allowed in flooring finishes was expected to begin diminishing the market share of oil-modified urethanes. It's likely too early for those rules to have much effect, but in any case, oil-modified remains the finish of choice for wood flooring contractors, according to the survey.

This year, contractors reported that 57 percent of the finishes they applied were oil-modified, while 33 percent were water-based. Those numbers are similar to the past three years' results, when the survey found that 53 (1999), 54 (1998) and 53 percent of the finishes used were oil-modified.

Water-based remains the second most-popular finish. Its market share among contractors was 39 percent in the 1999 survey, 38 percent in 1998 and 35 percent in 1997. The remainder were moisture-cure, conversion varnish and wax.

Wood flooring distributors reported numbers virtually identical to those reported by contractors.

Among distributors, oil modified finishes accounted for 53 percent of sales, while water-based finishes totaled 39 percent —virtually identical to last year's numbers.

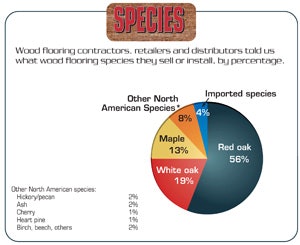

Species: This year, for the first time, we asked contractors, retailers and distributors to tell us which species they sold or installed most often.

No surprise: Red oak was most common at 56 percent, followed by white oak at 19 percent and maple at 13 percent.

All other North American species made up 8 percent, while imported species accounted for 4 percent of the wood flooring sold or installed in North America.

Brazilian cherry was the most common imported species at 2 percent, accounting for roughly half of the wood flooring species imported.

Growing room for everyone

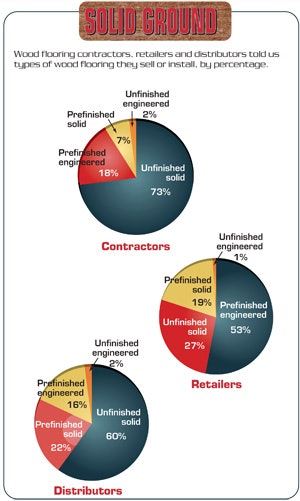

Unfinished solid is up, but so is prefinished engineered

Strip flooring is on a roll (see the chart below), but industry observers say prefinished engineered wood flooring is growing as fast or faster. While both product segments appear strong, each seems to be taking a slightly different path to the market. As in years past, the Hardwood Floors' survey again found that unfinished solid flooring is used most often by wood flooring contractors, while prefinished and engineered wood flooring dominate sales by retailers. The percentage breakdown this year is virtually unchanged from the 1999 survey.

Among those in this year's survey identified as contractors, unfinished solid flooring made up 73 percent of sales, compared with 72 percent in 1999. Prefinished engineered flooring was next highest at 18 percent, up from 12 percent in 1999 and 7 percent in 1998.

Prefinished solid wood flooring, thought by many to be an area for growth, does not appear to have made major inroads yet. The segment accounted for 7 percent of sales among contractors, 19 percent among retailers and 22 percent among distributors. The percentages are steady or slightly down from last year's survey.

Among floor-covering retailers, prefinished engineered flooring made up 51 percent of sales— the same percentage as last year — followed by unfinished solid at 27 percent. Prefinished solid accounted for 19 percent of retailer sales. In all, prefinished flooring made up 72 percent of retailer sales — down slightly from 80 percent last year.

In a survey of wood flooring distributors, unfinished solid flooring accounted for 60 percent of sales, prefinished solid for 22 percent, prefinished engineered for 16 percent, and unfinished engineered for 2 percent. Those numbers are very similar to last year's, when the breakdown was 64 percent, 19 percent, 16 percent and 1 percent.