The bad news in the media about the recession is relentless; it seems every day brings more terrible news about layoffs, home foreclosures, home values and the credit crisis. But wood flooring contractors don't have to turn on the TV or read the newspaper to find out about all that—they're living it every day. New building has stalled, the remodeling business isn't picking up the slack, and consumers are seemingly paralyzed with fear about the economy.

During these challenging times, Hardwood Floors talked with contractors across the country to find out how business is and what they're doing to handle the recession. Although the news was largely bad—"grim" and "horrid" were adjectives used to describe today's market—there were glimmers of hope. Not all contractors were experiencing a downturn, and even some who were felt that things might be starting to pick up. Most were aggressively taking action to adjust to the new economy and ensure their survival. Just how badly contractors have been hit depends in large part on what type of business they were doing and where they are located.

Brakes on Building

In most markets, tract building has all but disappeared, and even custom home building has slowed, if not stopped. Wood flooring contractors report that even their best custom builders have had homes for sale for as long as two years. Some builders have simply gone under.

Southern Florida has been one of the hardest hit areas in the housing crash, and not surprisingly, the industry there is suffering. High-end flooring company Creative Tile & Hardwood Floors, based in Naples, Fla., is now operating with 30 percent of the revenue it had two years ago, says Vice President/General Manager Steve Agius. In that market, the slowdown began back in March 2007. "It sounds ridiculous, but the bread and butter for us was the $2 million to $5 million house. We lived off those, and those just stopped," he says.

Phoenix also epitomizes the housing mess—so much so that President Obama chose it as the location to announce the details of his stimulus plan aimed at stemming foreclosures. Ironically, the resort where the president stayed in Phoenix is now in foreclosure, says Tricia Thompson, treasurer at Mesa, Ariz.-based Enmar Hardwood Flooring, which installed the wood floors in the 37 private villas at the resort. "We have so many foreclosures out here it is sickening," Thompson says. She says business started having uncharacteristic ups and downs in January 2008, but when the implosion of the banks came last October and November, "the brakes came on. It wasn't gradual, it was immediate."

While the crash was most severe in those markets, along with California, new building isn't doing much better elsewhere. Wood flooring contractors who had a diversified customer base are doing better than others, and many say homeowners are the key to success in this economy. Sid Grimes, owner at Harrisburg, N.C.-based Grimes Floor Service, says he learned during the recession in the early '90s that his business couldn't rely solely on new construction. "I've always tried to build that homeowner base, because when things get tight, you can't build that homeowner base. You've got to have it there; you've got to have the referrals going around," he says.

How Low Can You Go?

In this climate, some builders who still have work simply aren't installing wood floors at all. Mike Tipon, owner at Sonora, Calif.-based High Sierra Hardwoods, says that when he stops by local construction sites, the builders say they would like to hire him but they aren't installing hardwood floors. "They would love to do hardwood, but they're going to laminate because they can't afford the hardwood," he says. Tipon sees lower-cost floor coverings taking a bite out of the remodeling market, too, as big-box stores offer whole-house carpeting installation for $150 and local floor covering stores include a $250 gas card with an installation.

As a smaller wood flooring operation—himself and two workers—William Cavey, vice president at First-Rate Floors Inc. in Plano, Ill., says he also feels the pressure from the big local floor covering stores. "They are able to offer their customers zero-percent financing and no payments and all that," he says. "Being a small-business owner, it's just not feasible to offer that," he says, adding that despite the promotions and the extensive advertising those stores do, even the local floor covering chains are not busy right now.

Pressure is also intense from fellow wood flooring contractors, many of whom don't even have a legitimate business. In many markets across the country, contractors report that lowballing has reached new lows as people become more desperate for work. In his New Jersey market, John Blesing, president at Clifton, N.J.-based Blesing's Hardwood Flooring, says that, incredibly, some people are nailing prefinished flooring for 50 cents a square foot and unfinished flooring for 25 cents. "They want to get paid cash on the spot, and some builders are going for it because they're so cheap," he says. "How can you nail 1,000 feet for 500 bucks?" Fortunately, Blesing says, he has established relationships with good builders who won't go that route.

Mike Ogle, owner at Huntersville, N.C.-based Ogle's Hardwood Flooring, says a GC he had worked with for about the last 15 years recently cut him loose. "He had somebody come in basically just for the cost of materials doing the work," he says. "It seems everybody in the country with a pickup truck is in Charlotte right now, and they're cutting the prices to nothing."

Thompson sees the same in her Phoenix market. "What I see out here are a lot of knee-jerk reactions—'We'll do your floor for whatever.' They've taken the price point and shoved it right through the ground. It's pathetic what's being bid out here."

Between the lack of work and the cut-throat pricing, some wood flooring contractors simply aren't making it. Although there are no statistics available on the number of them that have gone out of business, contractors across the country all say they know of local wood flooring businesses that have gone under in the last year. On a positive note, however, they also expect the proliferation of fly-by-night installers to decrease, since there is so little work and their prices simply aren't sustainable.

Picking Price Points

Many contractors report that they've cut prices anywhere from 10 to 30 percent in order to compete, but others say they simply can't do that. Even for long-established, highend companies, the pressure to lower bids is intense.

Christopher Hildreth, president at San Francisco-based Tree Lovers Floors Inc. says his 36-year-old company is known for being "really expensive and really good," but even his history and his reputation haven't made him immune to the downturn. In August, he made the difficult decision to lay off 17 workers, about half his field staff. Then in September, he says, "We had all these signed contracts for $160,000, $170,000, for great big jobs we were doing. They called and said, 'Your estimate's off the table unless you can come down 20 percent.'" Now, business has been relatively steady, but he's taking one or two jobs a week at no profit just to make sure his remaining guys are working.

Some other contractors are doing the same. Tom Anderson, general manager at Albuquerque, N.M.-based Kimbrough Carpenter Inc., says he knows that some of his workers are the sole breadwinners for their families. He's been busy enough that he hasn't had to cut staff, and he's also willing to sacrifice margin to make sure that doesn't have to happen. "I don't care if our profit margin is the same as the year before or the year before that," he says. "Making sure I made as much money as I did last year—frankly, that's unimportant at a time like this."

Contractors are getting daily calls from guys looking for work. In the Washington, D.C. area, Tony Robison, general manager at Manassas, Va.-based Washington Wood Floors, says that although the company isn't doing as much work as last year, the profit margin is the same, and one reason is that he's been able to hire better workers who were laid off from other companies, bringing his man-hour cost down. The company also has avoided overtime and now has zero tolerance for things like employees stopping to eat on company time (Robison says he just fired a worker he caught hanging outside on the job site smoking while somebody else was inside working). To combat lowballers, Robison says the company has focused on customer service more than ever and strongly emphasizes to customers that the company is bonded and insured. He even reminds customers that if they hire a company without workers' comp and an employee gets hurt on the job, the customer is liable.

During such a slow market, Joshua Crossman, owner at Yelm, Wash.-based P.T.L. Hardwoods, is down from having two employees to just himself, but he finds his NWFA certification is giving him a boost with customers. In fact, recently he was sure he lost a job because the customers had gotten other bids that were lower, but they went with Crossman. "They went with me because of my knowledge and certification; they chose that over price. It's not always about price, and the jobs that are—maybe you don't want them," he says.

Happily, despite the economy, some contractors seem largely unaffected. Not only is Mark Strehlow, owner at Omro, Wis.-based Mark's Hardwood Flooring of Omro LLC, not cutting prices, he even considered raising prices this year, although he ended up deciding against it as a courtesy to his customers during a bad economy. A small operation—mainly himself and one other worker—he has such a strong word-of-mouth base that he's usually booked at least eight weeks out, even though the economy has shifted his business from being about half new construction to mainly remodeling. In Pottstown, Pa., Curt Sandberg, owner at Sandberg's Custom Hardwood Floors, says his prices are between 15 to 20 percent higher than most of the competition, but he's still "swamped." He attributes it to his focus on customer service and custom work in a relatively affluent market. In fact, he'd expand beyond his current four employees if doing so didn't create so many more headaches, he says.

Cutting Costs, Again and Again

For most contractors, the expenses that come along with having employees are more painful than ever. When business was booming, it was difficult enough to offer benefits such as medical insurance and retirement plans. Now, as budgets tighten, wood flooring contractors—like employers across the country—are constantly examining whether they can afford to have those benefits on top of the expenses they must pay, such as workers comp, liability insurance and unemployment insurance, to name a few. At Creative Tile & Hardwood, the housing meltdown has meant staff reductions from 125 to about 45, and those that are left are taking pay cuts, paying more of their own health insurance premiums and no longer getting company contributions to their 401(k) plans. Yet, Agius says, most of the remaining staff are long-time employees and understand the crisis. "They listen to the news, and they're just happy to be working," he says.

Some contractors who are used to being able to supervise have gone back to working in the field themselves, while others are still hoping to avoid it but consider it a possibility. "I would much rather keep my employees busy instead of having to put on the dust mask myself … but if my wages aren't being met, then I'm going to have to go out there and earn it that way," says Ken Ray, president at Kirkland, Wash.-based Foremost Hardwood Inc., adding that he's getting close to the age where he would like to be able to sell his business, but that in today's market, it has no value.

Besides cutting expenses related to employees, contractors are looking for other ways to trim budgets. Many have cut back on their fleets; others are selling equipment. Companies going out of business are also liquidating, leading to a proliferation of sanding equipment and vans on Craigslist and eBay. Even contractors who aren't desperate are examining each purchase carefully—do they really need that new tool? In turn, for manufacturers, selling new equipment has grown extremely difficult. One sanding equipment sales rep tells of a typical situation—a contractor was close to buying a new big machine, but then the contractor found the same one on eBay almost new for one-third the price (of course the rep lost the sale).

Meanwhile, contractors are also being more careful about coordinating driving to waste less time and gas, and they also are watching waste on the job. For example, Hildreth says that before, his workers were using the zippers for plastic sheeting once and throwing them away, at $10 each. Now they reuse them over and over again. They're also fixing many tools in-house to save money.

Cash Flow (or Lack Thereof)

To manage cash flow, contractors are keeping little to no inventory, and they say their distributors are calling them at least once a week asking for business and looking to make a deal. Contractors say they are shopping price more than ever and are letting their distributors know it. Distributors are also keeping the lowest inventory levels possible, though, so some contractors say they find it's best to stick with distributors they have a relationship with, to make sure they can get materials when they need them.

At a time when cash flow is critical, many contractors have begun having problems getting paid. Hildreth says he hates to do it, but he's considering hiring a collections agency for the first time. Grimes says that like any contractor, he's had problems with people paying in the past, but nothing like he's experiencing in the current economy. "There are so many more people trying to take you now, including homeowners," he says. "I'm trying to be a little more selective, but when things are tight, you tend to take on things you know maybe you shouldn't."

Many builders, especially tract builders, have gone under, and they have left a trail of creditors behind them. Grimes says he's bid on a few jobs where people are buying homes that weren't completed from the banks that took over the properties. He recalls one job he bid in Charlotte: "The guy from the bank pulled out a keychain about a foot long with about 70 keys on it, and he said, 'These are all the houses we've taken possession of.'"

The credit crisis has affected some wood flooring contractors directly. Now in its 12 th year, Ogle's Hardwood Flooring moved into a "big fancy" showroom in January, only to have to move right back out. "The bank had promised us a loan, and we basically spent all of our money fixing up our showroom. The bank reneged and said, 'Sorry, we can't do it.' It just about bankrupted us last year … we've had a terrible time finding credit," Ogle says.

On the Offensive

Wood flooring contractors aren't just suffering silently and cutting costs—many have put renewed energy into marketing, and they're finding that marketing today involves much more than just an ad in the Yellow Pages. For some, this is the first time, or the first time in a long time, they've ever had to worry about marketing. Many companies have relied solely on word-of-mouth for years.

Herb Fogelberg, vice president/CFO at Woodbury, Minn.-based Midway Hardwood Floors Inc., started his company during the recession in 1981 and quit advertising in 1986. "That's why it's been hard the last year-and-a-half with the recession coming in," he explains. All that time he was used to being booked two to three months out, and now he considers being booked two weeks out to be good.

By September, Enmar's Thompson was concerned enough about business slowing down that she hired a part-time marketing expert. "Everybody thought I was insane. They said, 'Do you understand what is going on?' I said, 'Yeah, do you?' Because I cannot afford not to do this," she says, adding that when business does pick up, she doesn't want to be playing catch-up. Enmar cut back advertising to what was working, and that now involves lots of partnering with companies such as designers, contractors, or cabinet and door companies that target a similar type of customer. Enmar installs a 10-by-10-foot display area in their showrooms for free. The company also does lunch-and-learn presentations, and is also marketing in California, where Enmar's green focus tends to resonate.

Companies are finding other free methods to advertise, as well. Robison uses Craigslist to advertise free monthly wood flooring installation seminars to customers, and that pulls 12 to 14 couples into the showroom each time. Some end up buying product only, while others end up buying installation, too.

In Albuquerque, Anderson is looking at many different avenues he can use to be more aggressive in getting the company's name in front of customers. Updating the company's Web site, doing directed mailings to previous customers, examining social networking, and advertising in Santa Fe, where the company has previously done only word-of-mouth business, are all either in the works or under consideration for this year.

Looking Ahead

In some markets, contractors report that although December and January were the most dismal months they've ever had, the phones were starting to ring more in February. Some are expecting business to improve as consumers start spending their tax refunds, and others think people will gain more confidence as the president's economic stimulus package is implemented. Others think it will be another year before business recovers from this slump. Regardless, no one expects business to return to the frenzied levels of several years ago.

What contractors did with their money during the building frenzy—whether they saved it or spent it on a luxurious house, fancy cars and vacation homes, for example—will be a deciding factor in which companies make it through the recession. Blesing points out that although the industry is suffering now, everyone in the industry benefited from the boom times before the crash. "If you were smart with your money and put it back in the company and saved it, you should be OK—now you can reach back and buckle down. If you didn't, you're done," he says.

"The profits that we made in '05 and '06 are what's been carrying us for the last two years, and we still have a little cushion there. Hopefully that's going to keep us going," Agius says. "Like everybody else, we're just treading water here, trying to keep our head above water until we get some kind of signal that the market has turned."

Although the recession is painful, some people do anticipate a long-term benefit to the industry: the elimination of many of the low-quality, bottom-feeder contractors who popped up during the boom times. As the industry emerges from the recession, the overall professionalism of people in the trade should be better, they say. Crossman says now is the time to check quality control, too: "It's a good time to check myself and make sure my job is the top of the line, because that's what's going to keep me busy," he says.

Anderson points out that because the upswing lasted so long, many people didn't pause to analyze their businesses. Now, they have no choice but to examine every aspect of what they do as a company. "It's been awhile since some of us have done that," he says, adding that some contractors haven't ever done it.

One thing is clear: What people discover as they examine their businesses, and the choices they make because of that, will determine whether they are still around to enjoy the next upswing in the wood flooring industry.

Doing the Math

In January, Hardwood Floors surveyed distributors and contractors to find out how they did in 2008 and which products they were using. Approximately 88 percent of contractors who responded specialized in wood flooring, while 91 percent of distributor respondents were wood flooring specialists. Here's what they told us:

Big Boxes

Of the contractors surveyed (more than one answer possible) ...

At a big-box store, contractors say they are most likely to buy (in order of likelihood):

- installation tools

- adhesives

- finish

- wood flooring

- abrasives

- sanding equipment

At a big-box store, distributors think their contractor customers are most likely to buy:

- wood flooring

- installation tools

- adhesives

- finish

- sanding equipment

- abrasives

Laminate

Of the distributors surveyed ...

44% sell a laminate product

56% do not

38% expect laminate to grow

62% do not

Purchasing Options

Of the distributors surveyed ...

34% said their business has been affected by big-box stores such as Home Depot and Lowe's

66% said they have not been affected by big-box stores

25% sell some product online

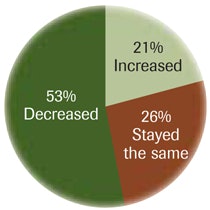

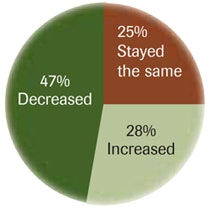

Contractors' Business in 2008 ...

In 2007...

• 36% of contractors indicated that business increased

• 36% stayed the same

• 28% decreased

Distributors' Business in 2008 ...

In 2007 ...

• 41% of distributors indicated that business increased

• 21% stayed the same

• 38% decreased

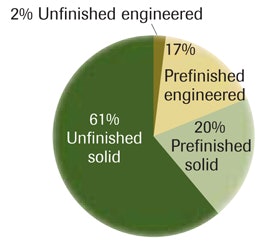

Contractors Are Installing ...

Contractor numbers in 2007 were ...

• 58% unfinished solid

• 23% prefinished solid

• 17% prefinished engineered

• 2% unfinished engineered

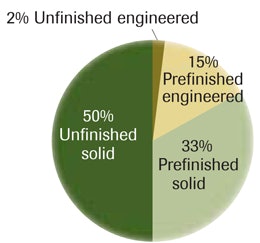

Distributors Are Selling ...

Distributor numbers in 2007 were ...

• 46% unfinished solid

• 29% prefinished engineered

• 22% prefinished solid

• 3% unfinished engineered

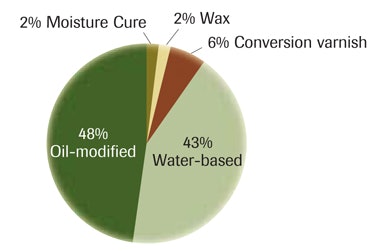

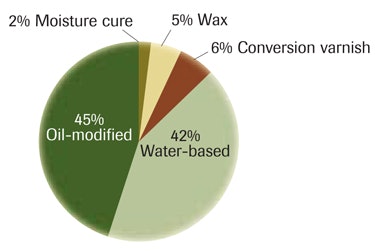

Finish Used by Contractors*

In 2007, contractors said ...

• 55% oil-modified

• 41% water-based

• 2% conversion varnish

• 2% wax

• 0% moisture cure

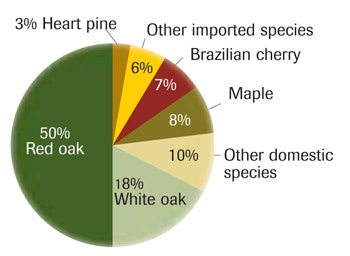

Species Installed by Contractors*

The contractor numbers in 2007 were ....

• 52% red oak

• 16% white oak

• 8% maple

• 8% other domestics

• 6% Brazilian cherry

• 4% other exotic species

• 4% heart pine

Finish Sold by Distributors

In 2007, distributors said ...

• 47% water-based

• 48% oil-modified

• 3% conversion varnish

• 2% moisture cure

• 1% wax

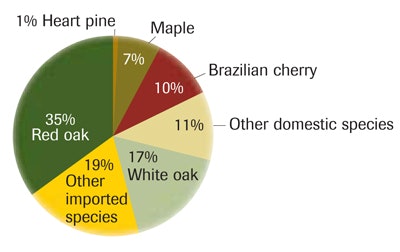

Species Sold by Distributors

The distributor numbers in 2007 were ....

• 44% red oak

• 16% white oak

• 13% other domestics

• 10% Brazilian cherry

• 7% maple

• 6% other exotic species

• 4% heart pine

How Contractors Spend Their Time

What They Do ...

In 2007, contractors divided their business, on average ...

• 51% sanding/finishing/refinishing

• 49% wood flooring installation

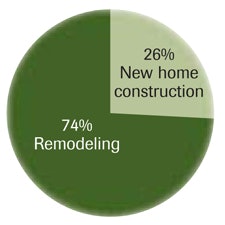

Brand New vs. Renew

In 2007, contractors divided their business, on average ...

• 67% remodeling

• 33% new home construction

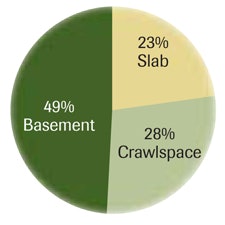

Subfloors Are ...

In 2007, contractors installed over ...

• 51% basement

• 27% crawlspace

• 22% slab

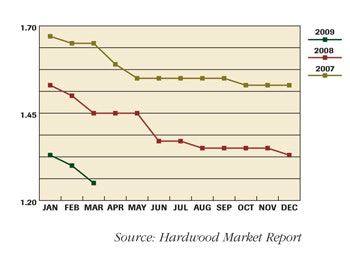

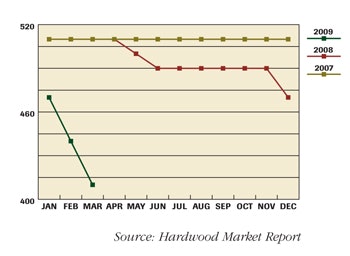

Appalachian Green 4/4 No. 2A Red Oak Lumber Price (per MBF)

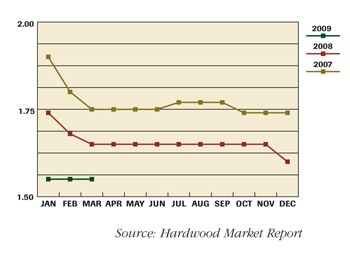

Appalachian 3/4 x 2 1/4 -inch Select Red Oak Price/Sq. Ft.

Appalachian 3/4 x 2 1/4 -inch No. 1 Common Red Oak Price/Sq. Ft.